Bitcoin is staging a modest rebound after a number of days of intense promoting stress and concern throughout the market. The main cryptocurrency has struggled to determine steady help, with unstable swings making it troublesome for merchants to navigate. Regardless of the uncertainty, some market individuals proceed to maneuver strategically — and one of the crucial well-known whales has simply made a giant return.

Associated Studying

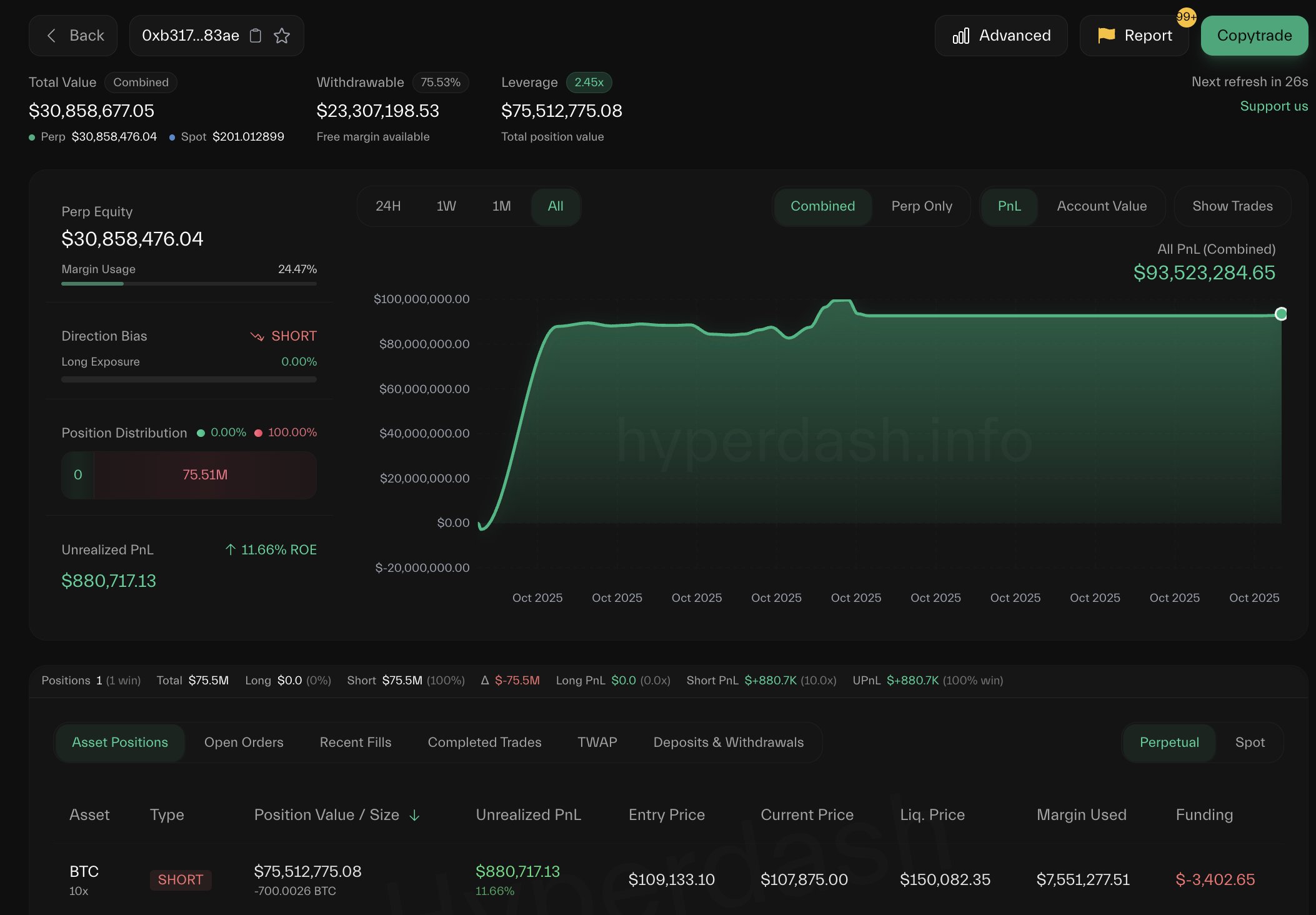

The dealer often known as BitcoinOG (1011short) — who gained fame for incomes over $197 million throughout final week’s flash crash — is again in motion. On-chain knowledge reveals that he has deposited $30 million in USDC to Hyperliquid and opened a 10x quick place on 700 BTC, value roughly $75.5 million.

This transfer has drawn the market’s consideration, reigniting hypothesis about whether or not the whale anticipates one other leg down for Bitcoin. Whereas BTC is trying to recuperate above the $110,000 mark, the presence of such a big quick place highlights lingering bearish sentiment and a scarcity of conviction amongst merchants. For now, bulls are preventing to stabilize worth momentum, however with whales like 1011short again within the recreation, volatility is probably going removed from over — and the market could also be in for one more sharp transfer quickly.

Whale’s Brief in Revenue as Market Pressure Rises

In line with Lookonchain, the whale often known as BitcoinOG (1011short) presently holds an unrealized revenue of about $880,000, or roughly 11%, on his newest $75.5 million quick place opened on Hyperliquid. The commerce, positioned throughout Bitcoin’s rebound part, has shortly gained traction as BTC struggles to maintain momentum above the $111,000 stage. This transfer has sparked unease amongst traders and merchants alike, lots of whom view it as a possible warning signal that bigger gamers could also be positioning for renewed draw back stress.

Nonetheless, analysts warn that this won’t inform the complete story. Whereas the 1011short tackle has earned a repute for precision — notably pocketing $197 million in the course of the October 10 flash crash — the transparency of on-chain knowledge has limits. It’s unclear what number of positions this whale presently holds throughout different exchanges or what the precise technique behind his trades could also be. As such, studying his strikes as a easy bearish wager may very well be an oversimplification.

The following few days will likely be crucial for Bitcoin’s trajectory. If the whale decides to scale his quick additional, it may intensify promoting stress and drag BTC towards key help ranges. Conversely, if he closes out the place or pivots to longs, it would counsel a short-term market backside. Both approach, the setup factors to heightened volatility forward, with merchants bracing for sharp worth actions because the market digests this high-profile exercise.

Associated Studying

Bitcoin Holds Weekly Help, however Resistance Looms

Bitcoin is displaying early indicators of stabilization on the weekly chart, recovering from its October 10 flash crash low close to $103,000 to commerce round $111,200. The candle construction means that patrons are defending the 50-week transferring common (blue line), which has acted as a dependable mid-cycle help all through the present bull part.

Nonetheless, the broader construction nonetheless reveals Bitcoin consolidating under the $117,500 resistance — a stage that has repeatedly capped rallies since mid-2025. Till BTC breaks above this zone with robust quantity, the market stays trapped in a sideways vary, with merchants positioning cautiously amid excessive volatility and unsure macro situations.

Associated Studying

Momentum indicators level to neutral-to-bearish sentiment, reflecting hesitation amongst bulls after weeks of heavy liquidations. But, the presence of upper lows on the weekly chart continues to help the long-term bullish construction, so long as BTC holds above $106,000–$107,000.

If worth manages to reclaim and shut above $117,500, the trail may open towards $125,000–$130,000, aligning with liquidity pockets from earlier tops. Conversely, a weekly shut under $106,000 would shift the outlook bearish, suggesting deeper corrections forward.

Featured picture from ChatGPT, chart from TradingView.com