Bitcoin and Ethereum rose after US President Donald Trump confirmed a gathering with China’s chief through the APEC summit on October 31. Based mostly on experiences, Bitcoin climbed practically 4% whereas Ethereum gained about 5% and traded round $4,030. The entire market added roughly $100 billion in worth in a brief window, in keeping with market watchers.

Associated Studying

Insider Whale Bets And Blended Positions

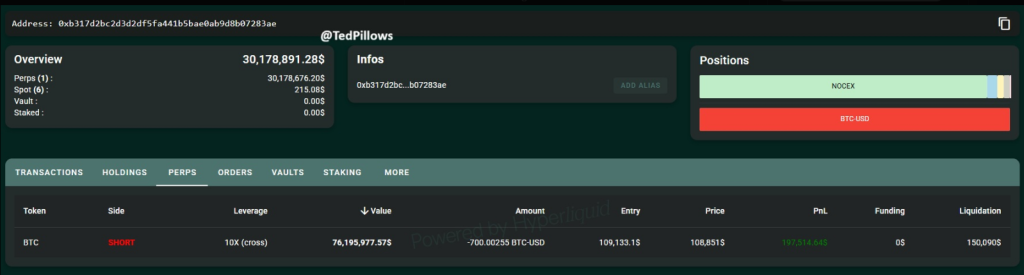

Reviews have disclosed that an insider whale opened $255 million in lengthy positions throughout Bitcoin and Ethereum. On the identical time, the identical dealer placed on a $76 million quick on Bitcoin with 10x leverage.

The strikes appear like a guess on swings in value relatively than a single directional stake. Observers be aware the dealer has a historical past of huge, well-timed trades, together with a previous $730 million quick that paid off. There isn’t a clear public ID for this whale, and the motives are being examined by analysts.

Insider Bitcoin whale is again.

He simply opened a $76,195,977 $BTC quick place with 10x leverage.

Does he know one thing? pic.twitter.com/K4ldvQE1TN

— Ted (@TedPillows) October 19, 2025

Political Shift Sends Costs Greater

Based mostly on experiences, feedback by US President Donald Trump helped calm markets. He reportedly mentioned “it’ll all be superb” when talking about China’s financial system, and the tone towards Beijing softened after every week the place he had introduced a 100% tariff on Chinese language items.

That tariff declare had sparked a giant sell-off throughout conventional and crypto markets simply days earlier. Market gamers reacted rapidly to the newest alerts of a thaw, viewing the upcoming assembly as an opportunity for decreased rigidity.

🚨BREAKING

AN INSIDER WITH A 100% WIN RATE JUST OPENED $BTC AND $ETH LONGS WORTH $255 MILLION

HE DEFINITELY KNOWS SOMETHING 👀 pic.twitter.com/hwAkXPzBwW

— Wimar.X (@DefiWimar) October 19, 2025

On-Chain Exercise And Institutional Strikes

In line with on-chain information and trade data, large-scale exercise continued throughout spot markets. BitMine was reported to have picked up about $1.5 billion price of Ether, a transfer that market members say reveals religion in Ethereum’s long-term outlook.

In the meantime, El Salvador quietly added eight BTC to its reserves, bringing its complete holdings to six,355.18 BTC.

Change Flows Present Withdrawals

Based mostly on trade data, main centralized platforms recorded a internet outflow of roughly 21,000 BTC over the previous week.

Coinbase Professional and Binance had been named amongst these with the most important withdrawals, exhibiting about 15,000 BTC and 12,000 BTC moved off exchanges, respectively.

Merchants interpret such flows in numerous methods: some see accumulation into non-public wallets, others see funds repositioned by giant merchants.

Associated Studying

The Implications Of This Transferring Ahead

Reviews point out that the market is reacting to each political alerts and positions being adjusted by large arms. If the rhetoric between the US and China continues to point out pleasant alerts, costs could push larger and retest month-to-month highs.

However the presence of a sizeable quick place alongside giant lengthy positions means that volatility will keep. Presently, information factors are being watched carefully and merchants are establishing balances between advancing positions and hedging.

Featured picture from Gemini, chart from TradingView