10 Nov Bitfinex Alpha | Market Consolidating, not Cascading

in Bitfinex Alpha

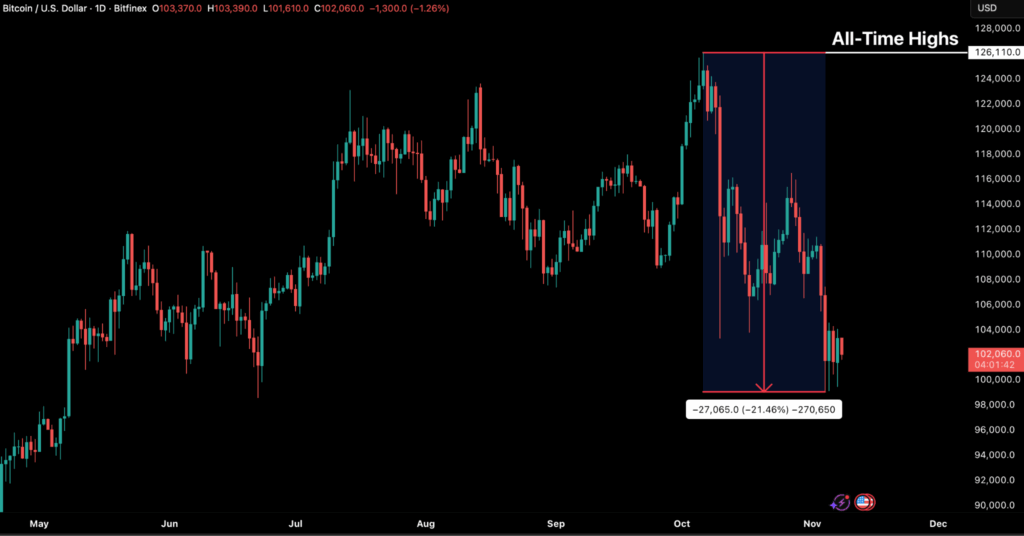

Bitcoin was down by as a lot as 21.46 % from its October all-time excessive final week, briefly dipping under the psychological $100,000 mark to a low of $99,045. Such a fall probably signifies the institution of a new consolidation base moderately than the onset of a cascading sell-off. Historic market and on-chain knowledge recommend that the present worth motion intently mirrors prior mid-cycle corrections, the place structural members stabilise publicity and capital rotates throughout the ecosystem earlier than broader uptrend continuation. The failure to carry above the short-term holders’ (STH) value foundation of $112,500 has led to a managed decline, bringing BTC again under that key stage and confirming the anticipated retest of deeper structural helps.

At these ranges, roughly 72 % of BTC provide stays in revenue, close to the decrease finish of the 70–90 % equilibrium band typical of mid-cycle slowdowns. This situation signifies that whereas promoting strain persists, a lot of the speculative extra has already been flushed out. The $88,500 Energetic Buyers’ Realised Worth now stands as the following main draw back reference, aligning with previous cycle assist zones the place capitulation traditionally transitioned into re-accumulation. Whereas transient aid rallies towards the STH value foundation stay probably, a sustained restoration will rely on renewed demand inflows from institutional and retail members. Till then, the market is anticipated to stay range-bound as volatility compresses and structural positioning resets forward of the following main cycle transfer.

The US economic system is flashing combined alerts the place company borrowing is bouncing again, however hiring is faltering. Within the absence of official knowledge, new private-sector knowledge present that the US labour market is weakening quicker than anticipated, with October’s ADP Nationwide Employment Report recording simply 42,000 new jobs, virtually all from giant corporations, whereas small and mid-sized firms shed employees for the third consecutive month. Client confidence has additionally fallen 6 % in November, signalling that households are beginning to really feel the pressure of slower hiring and coverage uncertainty.

The crypto trade is getting into a brand new section of mainstream adoption, pushed by document development in stablecoins and rising regulatory engagement worldwide. In October 2025, Ethereum-based stablecoins hit an all-time excessive of $2.82 trillion in month-to-month quantity, up 45 % from September, as traders rotated into dollar-pegged tokens amid market pullbacks and Ethereum’s increasing Layer-2 ecosystem enabled quicker, cheaper transactions. The milestone cements Ethereum’s position as a basis of digital finance, powering remittances, DeFi, and institutional settlements.

Regulators are additionally accelerating efforts to combine blockchain into conventional finance. In Japan, the Monetary Companies Company accredited a stablecoin pilot involving megabanks Mizuho, MUFG, and SMBC, set to start in November 2025, to check regulated digital funds below new monetary legal guidelines. In the meantime, in Australia, the Chair of the Australian Securities & Funding Fee (ASIC) Joe Longo urged the nation to embrace tokenisation to modernise its markets, saying a relaunch of the ASIC Innovation Hub and up to date licensing for stablecoins and tokenised securities.