Fed rate-cut odds reportedly dropped to round 14% after Donald Trump praised tariffs as a supply of US “wealth,” and crypto costs twitched in response. Bitcoin and main altcoins traded nervously as merchants reassessed how lengthy they may reside with larger US rates of interest. This performs out in opposition to a 12 months when central banks lower charges 32 occasions globally, so any trace that the US would possibly keep tighter for longer hits each shares and crypto quick.

What Does Trump’s Tariff Discuss Should Do With Fed Charge Cuts and Your Cash?

Let’s translate the jargon first. A “charge lower” refers back to the US Federal Reserve reducing rates of interest. Cheaper cash normally helps riskier belongings like Bitcoin as a result of borrowing prices drop and {dollars} look much less enticing when held in a financial institution.

The US is more and more an outlier. Whereas the US Fed lower odds sank to 14%, we watched the Financial institution of England and ECB each slash charges on December 18, totaling 32 world cuts this 12 months by Main central banks. Frankly, markets anticipated the Fed to hitch that occasion.

However when odds of a US lower slide to simply 14%, merchants hear one factor: cash stays costly. The consequence? This divergence is making the greenback appear like a ‘fortress,’ which is strictly what suppresses Bitcoin’s breakout momentum.

Now add tariffs. A tariff is sort of a tax on imported items. Trump not solely defended them, however he additionally praised them for creating wealth. Increased tariffs can push up costs, which might preserve inflation sticky. If inflation stays sticky, the Fed has much less cause to chop charges. That’s the reason Trump’s feedback matter to your Bitcoin stack, even when he by no means says the phrase “crypto.”

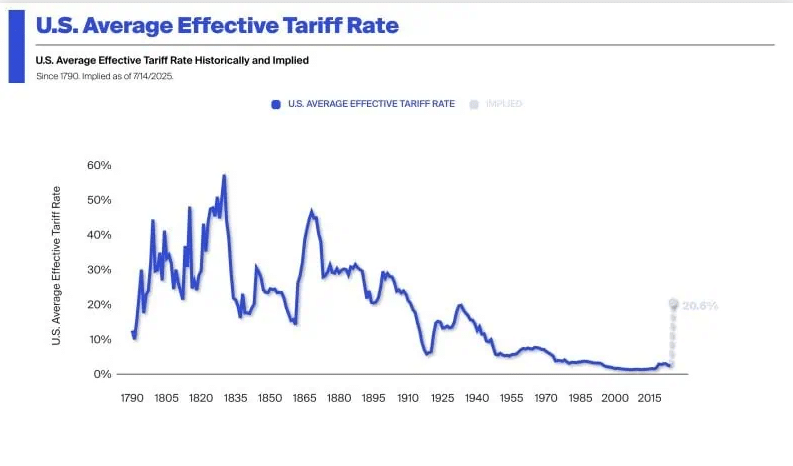

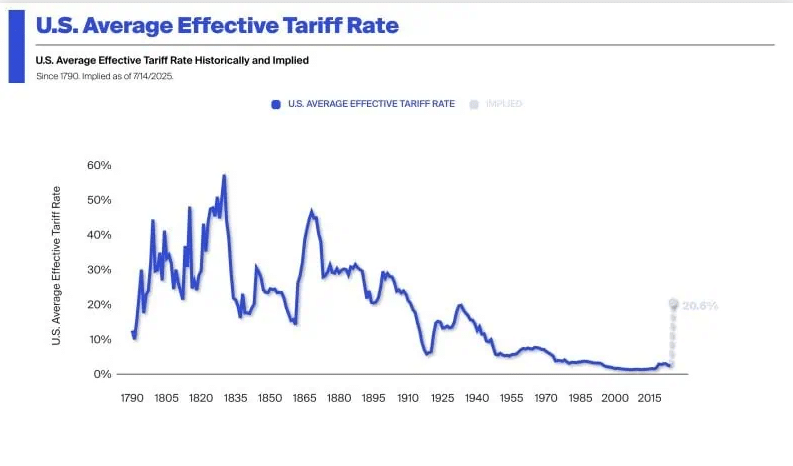

Whereas Trump praises tariffs as a ‘wealth builder,’ the info exhibits a distinct strain. The efficient U.S. tariff charge hit 17% in November 2025, a stage not seen since 1935. That is the true cause the Fed is hesitating; they will’t lower charges whereas a 17% ‘tax’ on imports is actively feeding the inflation fireplace.

(Supply – Knode Wealth Administration, US Common Efficient Tariff Charge)

Now we have seen this film earlier than. When Trump tariff headlines hit, Bitcoin usually swings onerous. Futures markets tumbled when earlier tariffs kicked in, and Yahoo Finance reported that BTC “dropped then popped” as merchants tried to cost in coverage chaos.

If you would like a broader learn on how central banks transfer hit Bitcoin value, test our protection of Federal Reserve liquidity and Bitcoin value and our information on charge cuts and the 2026 crypto outlook.

What Does This Macro Shift Imply for Bitcoin and Altcoin Traders?

When rate-cut odds fall, {dollars} look stronger and safer. That usually pushes some cash out of Bitcoin, Ethereum, SOL, and smaller cash, particularly these with tiny market caps that behave like high-beta tech shares. Crypto cares about liquidity. Costly cash means much less contemporary money chasing the following narrative.

Fed lower odds already swung wildly this 12 months, dropping to 30% throughout earlier political flare‑ups. That form of instability retains merchants jumpy and shortens their time horizons. They scalp strikes as a substitute of holding patiently.

There’s a flip aspect. Tariff stress and weaker client confidence, which AP Information reviews have hit new lows since tariffs have been rolled out, can immediate some buyers to view Bitcoin as a hedge in opposition to coverage chaos. So that you generally see an odd combine: brief‑time period selloffs when charge expectations shift, adopted by “flight to onerous belongings” narratives, particularly if the greenback begins to wobble once more.

In case you observe US laws and politics in crypto, it additionally ties into the broader coverage story we cowl in our piece on US crypto regulation, which is altering, and the way Trump-era financial concepts have already formed Bitcoin reactions.

EXPLORE: Greatest Meme Coin ICOs to Put money into 2025

How Ought to Newcomers Handle Danger When Politics Whipsaw Crypto?

First, deal with macro headlines like climate alerts, not buying and selling indicators. They matter, however overreacting to each Trump quote or Fed odds shift normally ends in FOMO buys on the prime and panic sells on the backside.

Second, match your technique to your time horizon. In case you stack Bitcoin as a multi‑12 months financial savings experiment, a transfer in charge‑lower odds from 30% to 14% is brief‑time period noise. In case you commerce altcoins based mostly on narratives, that very same transfer can drain liquidity and make sharp wicks extra doubtless, particularly on skinny order books.

Third, dimension your danger. By no means use lease cash or emergency financial savings for this a part of your portfolio. Deal with it like enterprise capital: excessive danger, presumably excessive reward, all the time elective.

Lastly, separate your “macro training” out of your precise purchase button. Be taught what charge cuts, tariffs, and greenback power imply so you don’t really feel misplaced when charts transfer. Macro drama will proceed to swing between concern of tariffs and hope for charge cuts. In case you keep targeted on training, place sizing, and time horizon, fairly than reacting to sizzling takes, you remodel that noise into context as a substitute of chaos.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Knowledgeable Market Evaluation.

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s crew members have been crypto specialists since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Knowledgeable contributors

2000+

Crypto Tasks Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the most recent updates, traits, and insights delivered straight to your fingertips. Subscribe now!