Bitcoin’s April 2025 swing low round $73,000 has grow to be the make-or-break line for 2026, in keeping with veteran skilled dealer and commentator Nik Patel, who argues {that a} higher-timeframe break under that stage would seemingly open the door to a chronic grind within the mid-$50,000s.

In Half Three of his “2026 Outlook” revealed Jan. 21, Patel laid out a high-conviction name that Bitcoin prints recent all-time highs within the first half of 2026, framing it as additional proof the market has shifted away from the clear, narrative-driven four-year cycle. “Bitcoin trades new all-time highs in H1 — the 4-year cycle is useless,” he wrote, summarizing his regime view as “increased for longer,” doubtlessly stretching into 2027.

Why Bitcoin Should Maintain $73,000 Or Threat A Slide

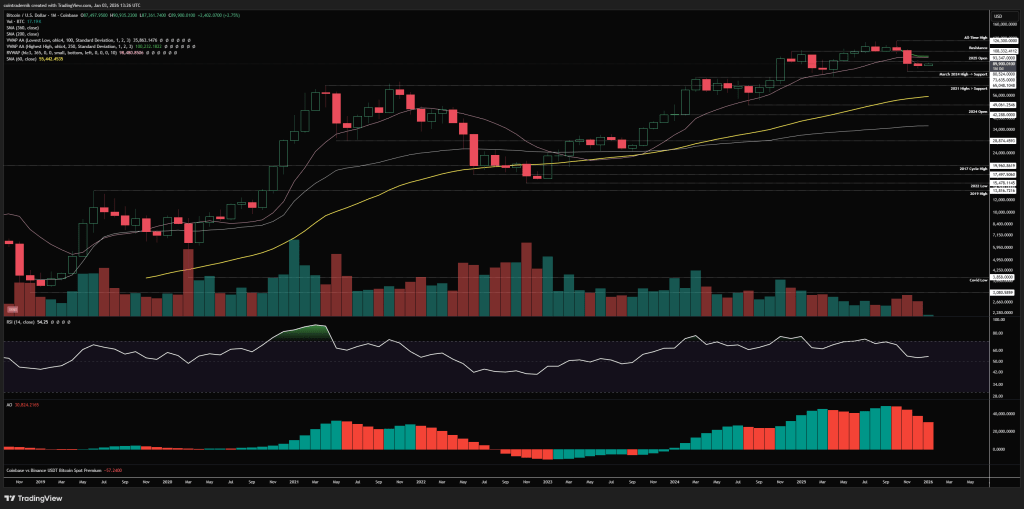

Patel’s core technical declare is straightforward: so long as Bitcoin doesn’t shut key increased timeframes under the April 2025 low, the broader construction stays intact and the bottom case is continuation increased. He acknowledged that he anticipated a sharper reversal earlier: “Timing-wise, I used to be unsuitable on my expectations for a extra quick reversal,” however confused that worth has continued to carry above the April lows “regardless of having each purpose to interrupt and shut under.”

Associated Studying

That resilience, in his view, issues greater than transferring averages or anchored references. “Since 2022, we’ve got not made recent lows on a weekly timeframe under the bottoms that preceded the following highs (or, extra plainly, weekly construction in probably the most technical sense has remained bullish with higher-highs and higher-lows),” Patel wrote.

“This has not modified and I place much less weight on MAs, VWAPs and many others. than I do on worth itself, and while the $73k April lows that preceded the $126k all-time highs are protected, weekly construction continues to be bullish.”

His forecast leans closely on a macro and positioning backdrop he describes as inconsistent with a deep-cycle crypto bear market. Patel cited “Goldilocks into reflation,” rising inflation breakevens, falling actual charges, midterm dynamics, and bearish sentiment and positioning as a part of the setup that makes a 2018- or 2022-style unwind much less seemingly in his framework.

Patel’s draw back map is unusually specific for a discretionary macro-technical thesis. “If I’m unsuitable — and we shut the upper timeframes under $73k — we seemingly commerce mid-$50ks this 12 months, consolidate there for a lot of months and produce no new highs in 2026,” he wrote, outlining a state of affairs the place a structural failure forces a wholesale reassessment.

He reiterated that the set off isn’t an intraday wick however timeframe closes. In his year-ahead playbook, he described being “invalidated on a weekly shut under $73k however with a view to re-entering on a direct reclaim,” whereas “absolutely” slicing publicity if Bitcoin prints a month-to-month shut under $73,000, during which case he would “put together for mid-$50ks.”

Associated Studying

Patel additionally pushed again on the concept the drawdown from the highs represents a brand new, uniquely bearish regime. “The place many view the latest transfer off the highs into $80k as a ‘structural shift not like prior corrections’, I disagree and proceed to view this as a ‘increased for longer’ regime inside which we’ve got these 30-40% corrections, range-bound price-action chewing by means of provide and subsequently proceed increased,” he wrote.

He added that the correction “felt completely different” partially as a result of it coincided with what he known as “the biggest liquidation occasion in crypto historical past,” alongside compelled promoting dynamics and long-term holder provide, but it has nonetheless solely produced a drawdown modestly bigger than prior pullbacks within the broader uptrend.

Even so, Patel allowed for near-term turbulence. He mentioned there may be “a good likelihood we sweep the November low in early Q1,” however maintained he “categorically” doesn’t count on a higher-timeframe shut under the April lows within the first half of the 12 months. His base case stays new highs in H1 2026—“maybe in late Q1 however seemingly in early Q2.”

At press time, BTC traded at $90,060.

Featured picture created with DALL.E, chart from TradingView.com