The SSL Hybrid MT5 Indicator tackles this actual downside. It cuts by market noise by exhibiting merchants which route truly has momentum behind it. As an alternative of reacting to each worth swing, merchants get a visible framework that separates real pattern strikes from uneven, range-bound motion. This text breaks down how the indicator capabilities, the place it shines, and—simply as importantly—the place it falls quick.

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and previous efficiency doesn’t predict future outcomes. What follows is a technical evaluation of 1 instrument amongst many who merchants use to tell their selections.

What the SSL Hybrid Indicator Really Does

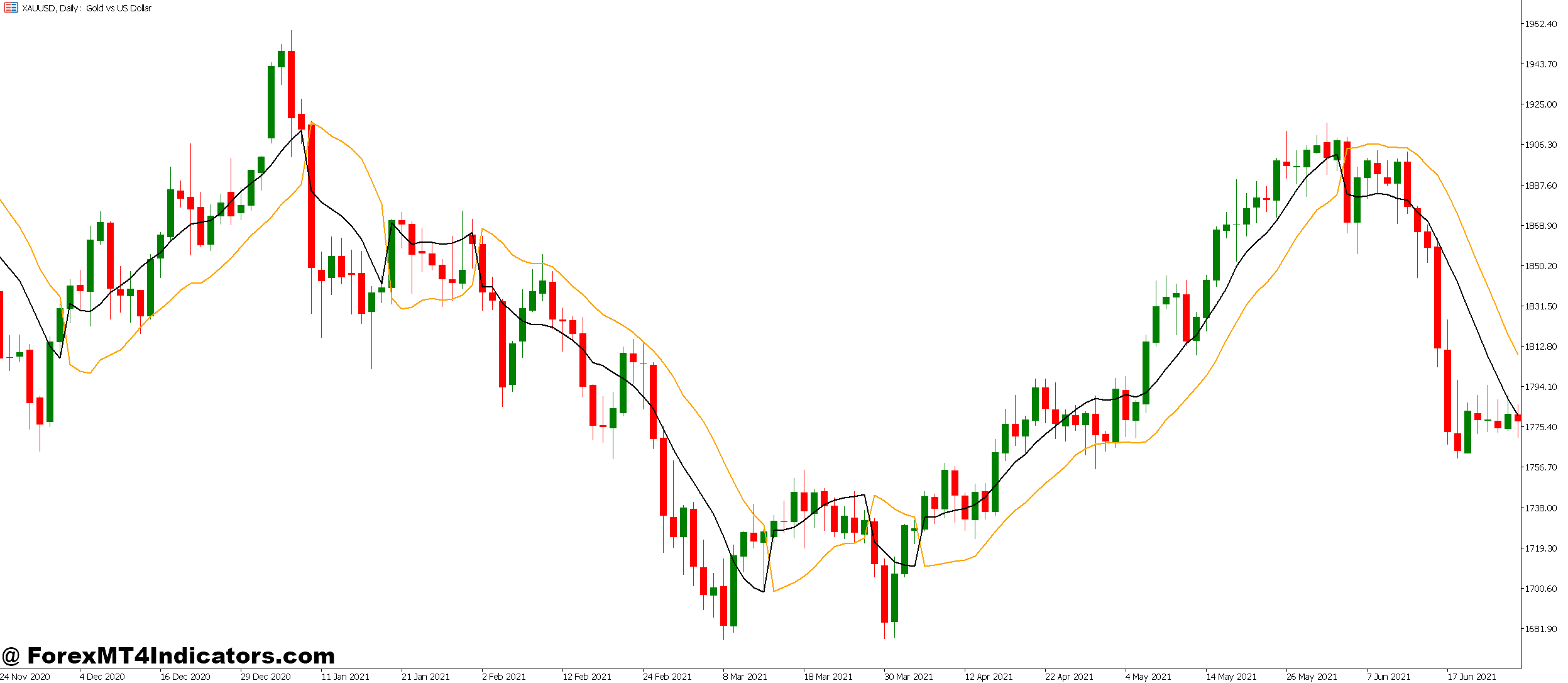

The SSL Hybrid combines two separate channel techniques into one visible instrument. Consider it as having each a fast-reacting sensor and a slower, extra secure filter working collectively. The indicator plots coloured strains above and under the worth—when the pattern shifts from bullish to bearish (or vice versa), these strains flip place and alter shade.

In contrast to single-line transferring averages, SSL Hybrid creates a channel zone. This zone expands throughout unstable intervals and contracts when the worth consolidates. Merchants use it primarily for pattern route and entry timing, not as a standalone system.

The “hybrid” identify comes from its dual-baseline strategy. It doesn’t simply monitor one transferring common interval; it displays each a quick-moving line for sensitivity and a slower line for affirmation. When each agree on route, merchants get a higher-confidence sign.

The Technical Mechanics Behind the Alerts

Right here’s the place issues get particular. The SSL Hybrid makes use of exponential transferring averages (EMAs) utilized to the excessive and low of every candle. The default settings sometimes use a 10-period EMA for the quick line and a 20-period EMA for the baseline.

When worth trades above the channel, the indicator plots a inexperienced zone—signaling bullish circumstances. Drop under, and it switches to crimson for bearish. However there’s a twist: the indicator doesn’t flip instantly on one candle crossing. It waits for the EMA channels to totally cross one another, which filters out minor retracements.

The calculation seems at whether or not the quick EMA of the highs crosses above or under the sluggish EMA of the lows. That crossover level turns into the set off for shade modifications. This lag—normally 1-3 bars relying on volatility—retains merchants from leaping into each fake-out.

In observe, this implies GBP/JPY would possibly present bullish colours whereas the worth briefly dips under the channel. The indicator holds its sign as a result of the underlying EMAs haven’t absolutely crossed. That endurance prevents untimely exits throughout regular pullbacks.

Actual Buying and selling Purposes and Entry Logic

The place merchants truly use this: pattern affirmation on larger timeframes and entry refinement on decrease ones. A typical strategy places SSL Hybrid on the 4-hour chart to determine the dominant pattern, then drops to 15-minute charts for particular entries.

Let’s say the 4-hour EUR/USD chart reveals inexperienced SSL channels on Tuesday morning. Worth is above each strains, and momentum seems clear. A dealer watching this wouldn’t take shorts in opposition to that construction. As an alternative, they’d look forward to the worth to retrace to the inexperienced channel line, then search for bullish patterns—pin bars, engulfing candles, no matter their system makes use of.

The 15-minute chart provides precision. If the larger pattern is up, however the 15-minute SSL flips crimson quickly, that’s not a reversal sign. It’s a pullback alternative. Good cash waits for the 15-minute to flip again to inexperienced, confirming the decrease timeframe aligns with the upper one.

In the course of the London session on USD/JPY, this setup caught a 60-pip transfer final month when the 4-hour stayed bullish whereas the 1-hour made a quick dip into crimson territory. The re-entry as a 1-hour flip again to inexperienced gave a clear entry with outlined threat under the channel.

Customizing Settings for Totally different Market Circumstances

Default settings work positive for main pairs on commonplace timeframes. However unique pairs or news-heavy classes want changes. The quick EMA interval (sometimes 10) and baseline interval (sometimes 20) are the 2 variables that matter most.

For uneven pairs like GBP/NZD, bumping the quick interval to fifteen and baseline to 30 reduces false alerts. The trade-off? Slower response to real pattern modifications. It’s at all times a steadiness between sensitivity and reliability.

Scalpers on 1-minute charts would possibly decrease settings to five and 10 to catch faster strikes. That mentioned, whipsaw threat jumps considerably. The indicator wasn’t designed for ultra-fast timeframes the place spreads and slippage eat most income anyway.

Forex pairs with easy developments—like AUD/NZD or EUR/GBP—deal with default settings nicely. Unstable movers (GBP/JPY throughout Tokyo open) profit from wider settings. Some merchants run two variations concurrently: one for alerts, one for filters with completely different intervals.

Shade schemes matter lower than most assume, however visibility throughout completely different chart backgrounds helps. Inexperienced/crimson is commonplace, however blue/orange works higher for colorblind merchants or these utilizing darkish themes.

The Strengths and Trustworthy Limitations

SSL Hybrid excels at conserving merchants on the suitable aspect of established developments. It prevents the basic mistake of shopping for each dip in a downtrend or promoting each rally in an uptrend. The visible readability—seeing worth relative to coloured zones—makes pattern route instantly apparent.

It additionally filters out minor noise successfully. Single-candle spikes don’t flip the indicator, so merchants keep away from panic reactions to momentary volatility. The channel zone supplies dynamic assist and resistance ranges that regulate mechanically as developments develop.

Now the fact verify: SSL Hybrid lags throughout pattern transitions. By design, it wants affirmation earlier than switching colours, which suggests the preliminary reversal transfer occurs with out warning. Merchants getting into on shade flips sometimes miss the primary 20-40% of a brand new pattern.

Vary-bound markets homicide this indicator’s effectiveness. When EUR/USD spends three days bouncing between 1.0850 and 1.0900, SSL will flip colours each few hours, producing shedding sign after shedding sign. No trend-following instrument handles consolidation nicely.

False breakouts happen, particularly round main information occasions. The indicator would possibly flip inexperienced simply as NFP information drops and worth reverses violently. It might’t predict fundamentals, solely react to cost construction. Merchants combining SSL with quantity evaluation or order circulation instruments get higher outcomes.

In comparison with MACD or RSI, SSL Hybrid doesn’t measure momentum power—simply route. It received’t present overbought or oversold circumstances. Paired with an oscillator, although, it turns into considerably extra helpful. The indicator works greatest as one part in a broader system, not as a solo decision-maker.

The right way to Commerce with SSL Hybrid MT5 Indicator

Purchase Entry

- Await inexperienced channel affirmation – Enter solely after each SSL strains flip inexperienced and worth closes above the channel; keep away from entries throughout shade transitions to forestall false breakouts.

- Enter on pullback to the inexperienced line – On 4-hour EUR/USD, look forward to worth to retrace and contact the decrease inexperienced channel line, then enter when subsequent candle reveals bullish momentum with 15-20 pip cease under the channel.

- Verify with larger timeframe alignment – Test each day chart reveals inexperienced SSL earlier than taking 1-hour purchase alerts; this multi-timeframe affirmation will increase win price by filtering counter-trend trades.

- Keep away from shopping for when the channel is just too vast – If the inexperienced channel spans greater than 80 pips on the GBP/USD 1-hour chart, volatility is extreme, and whipsaw threat will increase—look forward to consolidation.

- Use the quick line as a trailing cease – As soon as in revenue by 30+ pips, transfer the cease loss to simply under the decrease inexperienced line; exit instantly if SSL flips to crimson earlier than the goal.

- Don’t chase worth far above channel – If EUR/USD trades 40+ pips above the higher inexperienced line on 15-minute chart, sign is overextended—look forward to pullback slightly than shopping for at extremes.

- Skip alerts throughout main information occasions – Keep away from entries half-hour earlier than and after NFP, rate of interest selections, or CPI releases; SSL can’t predict fundamental-driven volatility spikes.

- Require at the least 3 inexperienced candles – After SSL flips from crimson to inexperienced, look forward to 3 consecutive bullish candles on the 1-hour chart to substantiate pattern power earlier than getting into.

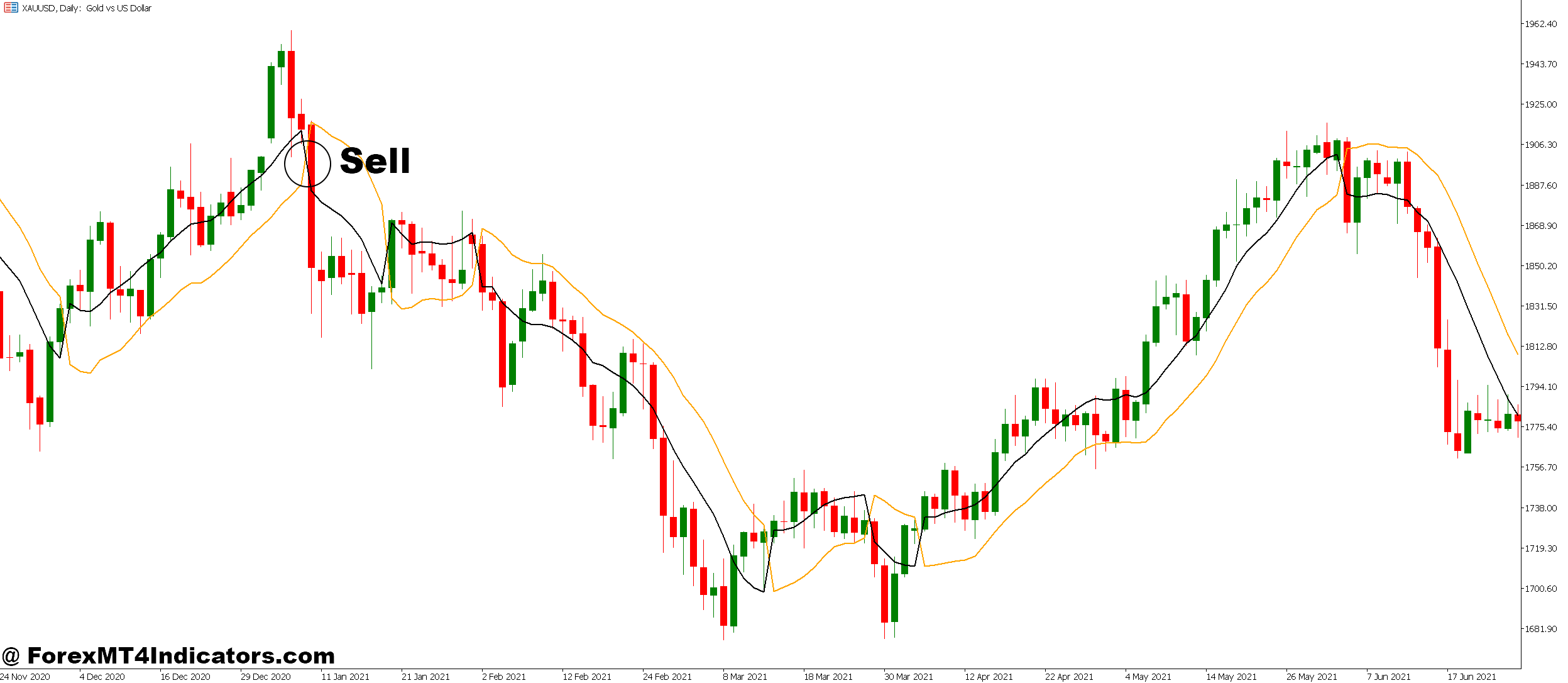

Promote Entry

- Enter when SSL flips fully crimson – Take promote positions solely after each channel strains flip crimson and worth closes under; untimely entries throughout the flip trigger pointless losses.

- Promote on rallies to the crimson line – On 4-hour GBP/USD, look forward to worth to bounce as much as contact the higher crimson channel line, then enter quick when rejection candle seems with 20-25 pip cease above.

- Test each day pattern helps your promote – By no means promote on 1-hour crimson SSL if each day chart reveals inexperienced; buying and selling in opposition to larger timeframe SSL shade reduces success price under 40%.

- Keep away from tight ranges – If EUR/USD on 4-hour bounces between crimson and inexperienced each 6-8 hours, the market is ranging, not trending—skip all SSL alerts till clear directional motion emerges.

- Path stops utilizing the higher crimson line – After gaining 25+ pips, regulate cease to simply above the higher crimson channel; exit full place if SSL switches to inexperienced.

- Don’t promote when worth drops too far under – If GBP/JPY trades 60+ pips under the decrease crimson line on 1-hour, promoting is late—both look forward to bounce again to channel or skip the sign.

- Ignore alerts throughout skinny liquidity hours – Skip SSL flips throughout Asian session on USD pairs, or Sunday opens; low quantity causes erratic worth motion that triggers false crimson alerts.

- Verify with momentum – Earlier than promoting crimson SSL on the 15-minute chart, confirm worth made a decrease excessive and decrease low—sample affirmation prevents promoting into non permanent dips inside uptrends.

Conclusion

SSL Hybrid MT5 Indicator delivers pattern readability with out overwhelming charts with information. Merchants get directional bias from shade zones, dynamic assist/resistance from the channels, and false-signal filtering from its dual-EMA construction. It handles main foreign exchange pairs throughout trending circumstances successfully, giving each swing merchants and place holders a dependable visible information.

The instrument calls for sensible expectations. It received’t catch each reversal early, received’t deal with ranges profitably, and received’t work with out correct threat administration behind it. What it does do is maintain merchants aligned with momentum and out of counter-trend disasters.

Threat administration nonetheless trumps indicators each time. Place sizing, cease placement, and capital preservation matter greater than any technical instrument. Use SSL Hybrid as directional affirmation, mix it with worth motion or different indicators, and take a look at completely on demo accounts earlier than risking actual capital. The very best indicator setup means nothing with out disciplined execution backing it up.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90