🔥 Chapter 1 – Introduction

Grid buying and selling techniques have lengthy been favored by merchants—particularly for his or her potential to revenue from unstable, sideways markets. However when deployed over longer intervals or with growing capital, many basic EAs reveal large weaknesses which are insufficiently addressed.

❌ Widespread Points with Traditional Grid Techniques:

-

Countless averaging with no outlined exit level

→ Markets run “towards the grid”—new trades are added till the account is liquidated. -

Martingale logic with exponentially growing place sizes

→ Excessive mathematical threat, usually hidden within the code -

No true threat administration

→ No strategic or portfolio-level stop-loss management -

Not appropriate with prop agency guidelines

→ No drawdown management, no behavioral patterns, no technique diversification -

Multi-grid techniques with out foreign money filters

→ Losses accumulate uncontrollably throughout pairs sharing the identical base foreign money (e.g., USD)

💡 Why Burning Grid?

Burning Grid EA was developed particularly in response to those weaknesses. The purpose was a very restructured grid method that:

-

Makes use of clearly outlined methods with restricted threat per image

-

Eliminates Martingale logic totally

-

Integrates strategic exit factors with accepted losses

-

Provides totally configurable threat administration on each account and foreign money stage

-

And is prop agency prepared, together with entry level randomization

🔘 The result’s a system that’s controllable, scalable, and institutionally deployable—with out the standard flaws of legacy grid bots.

⚙️ Chapter 2 – Technique Logic & Threat Modeling

2.1 Fastened Methods per Image & Threat Profile

Burning Grid operates with predefined, clearly structured methods. Relying on the chosen threat profile (Low / Medium / Excessive), about two methods per image are activated concurrently. These methods differ in entry logic, grid construction, and exit logic however are non-adaptive and by no means use Martingale mechanics.

2.2 Strategic Exit Logic with Managed Loss

Every technique has a predefined exit level. If the market strikes unfavorably, the place is closed at a managed loss. The utmost loss is strictly restricted by the assigned capital threat (e.g., 1% per Purchase technique).

2.3 Lot Measurement Calculation – Purely Threat-Based mostly

Place sizing is predicated solely on the assigned capital threat (in %). Market parameters like unfold or volatility haven’t any affect. This ensures constant and clear place sizes throughout all methods.

🛡️ Chapter 3 – Execution Filters & Drawdown Management

3.1 Information Filter As a substitute of Time Periods

Burning Grid doesn’t use a session filter or buying and selling time window. As a substitute, it features a information filter that forestalls new trades earlier than high-impact occasions. This reduces volatility dangers and avoids surprising market habits.

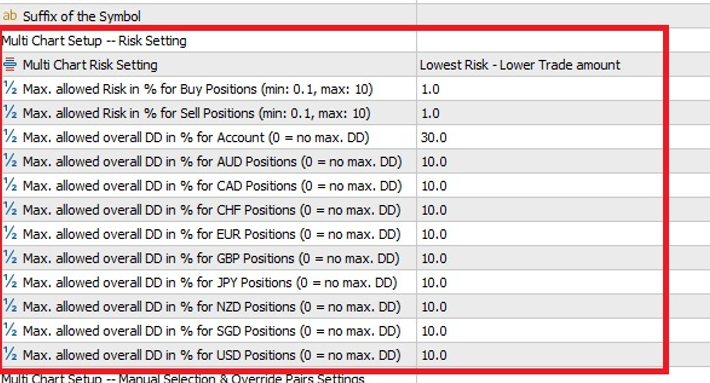

3.2 Account- and Forex-Based mostly Drawdown Safety

A core power of Burning Grid is its dual-level drawdown safety:

-

Account Drawdown (in %): A world ceiling ensures that losses stay throughout the predefined max loss worth.

-

Forex Drawdown Filter: The person can outline a max drawdown (e.g., 10%) for any base foreign money. When triggered:

This enables higher management over correlation dangers—e.g., simultaneous publicity to USD by way of AUDUSD, USDJPY, and USDCAD.

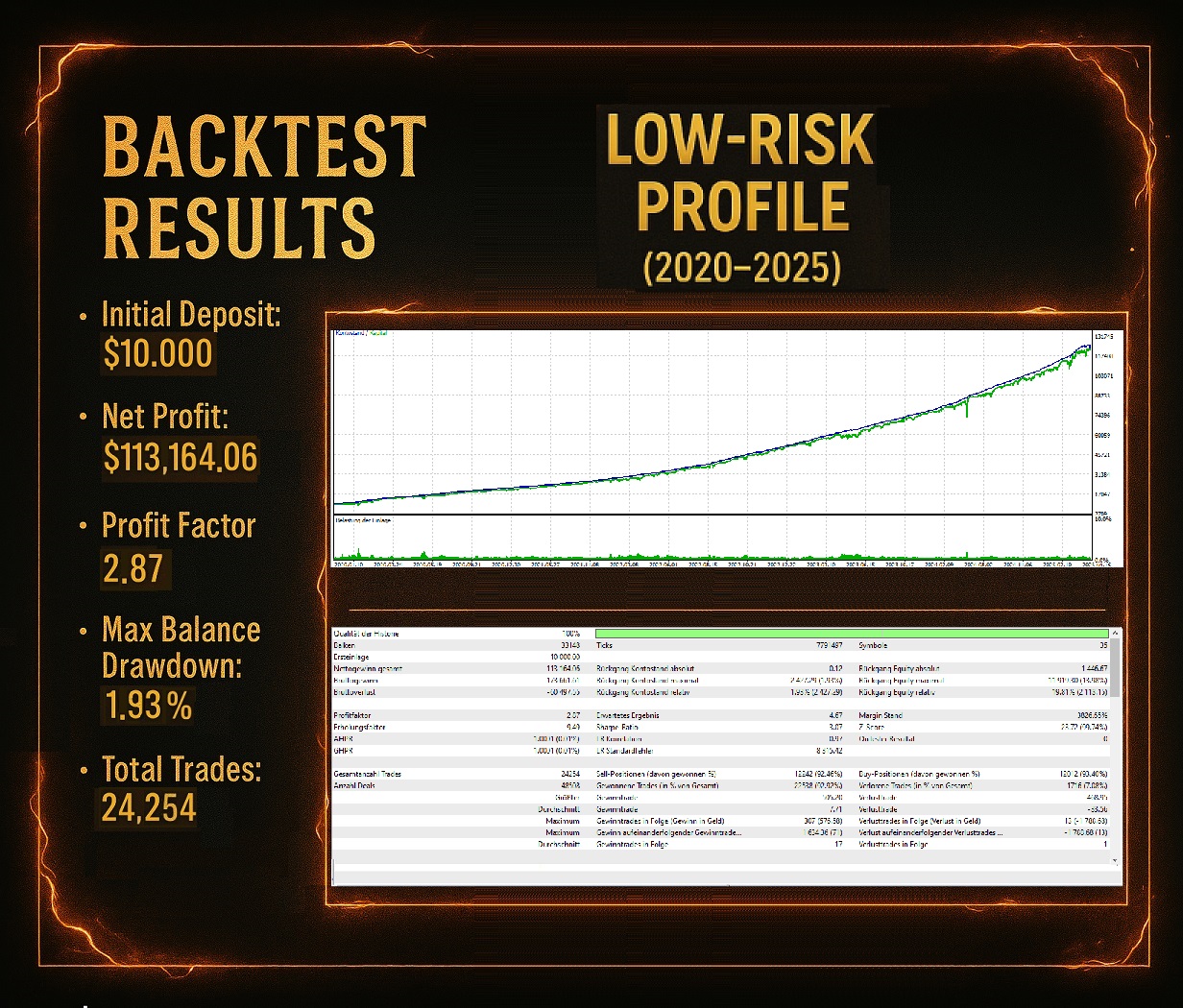

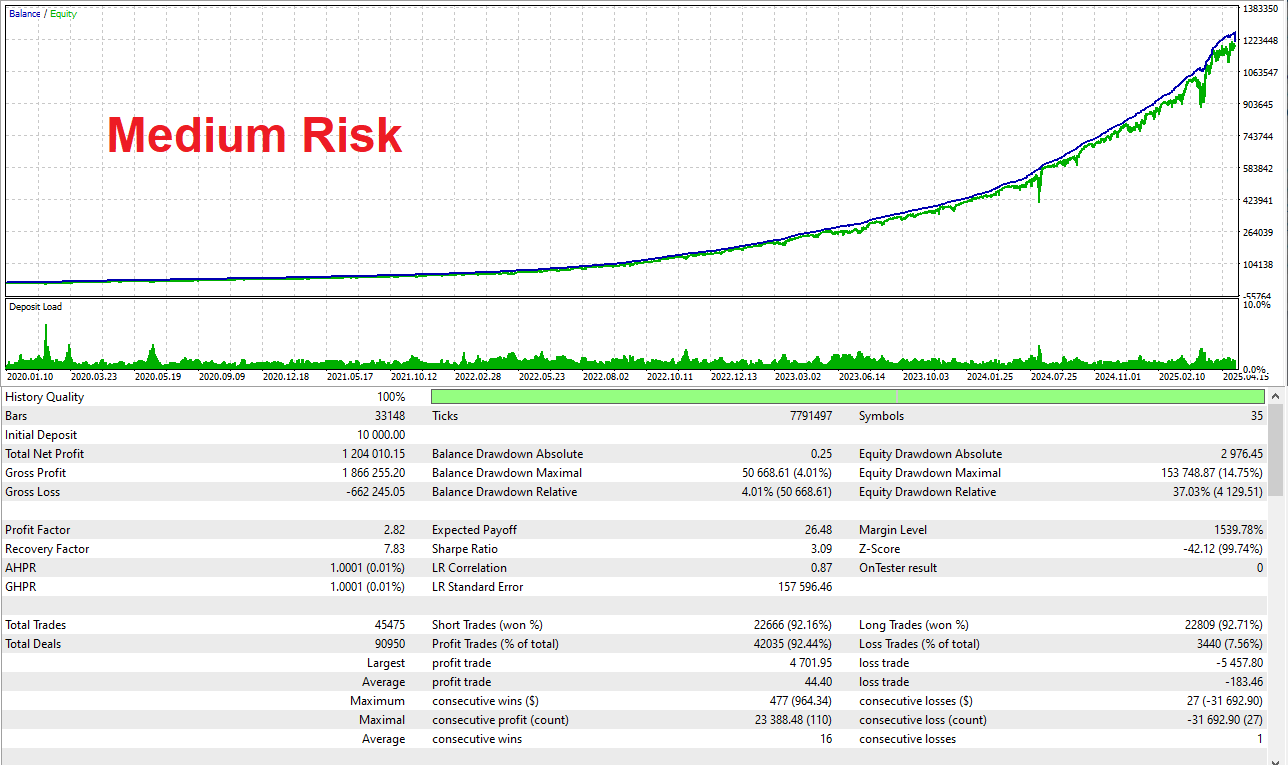

🧠 Chapter 4 – Backtests & Efficiency Analysis

4.1 Backtest Setup & Methodology

Burning Grid was examined with practical market information:

-

Timeframe: 1-minute OHLC (no tick simulation)

-

Supply: IC Buying and selling Dwell Account (Uncooked Unfold)

-

Threat Presets: 1% per Purchase/Promote technique throughout all profiles (Low / Medium / Excessive)

No curve becoming or optimization was utilized—presets remained fastened throughout all pairs.

4.2 Key Metrics (Medium Threat Profile Instance)

-

Web Revenue: $1,2040,010.15

-

Revenue Issue: 2.82

-

Max Stability Drawdown: 4.01%

-

Win Fee: 92.44%

-

Sharpe Ratio: 3.09

-

Interval: 2020–2024

4.3 Drawdown Conduct & Fairness Curve

The drawdown habits stays linear and manageable—even in adversarial situations. The absence of a Martingale impact is clearly seen.

4.4 Ahead Assessments & Dwell Execution

Preliminary demo ahead checks confirmed stay compatibility:

-

Constant habits underneath actual spreads

-

No order slippage or anomalies

-

Life like fairness and threat development

4.5 Dwell Sign Efficiency (MQL5)

Burning Grid is verified in stay situations via three official MQL5 alerts:

🔹 Low Threat

-

Progress: 73%

-

Revenue: €382.15

-

Max DD: 13.25%

-

Revenue Issue: 24.54

-

Trades: 347

-

Win Fee: 99.42%

-

Sign

🔹 Medium Threat

-

Progress: 140%

-

Revenue: €734.46

-

Max DD: 19.77%

-

Revenue Issue: 21.58

-

Trades: 641

-

Win Fee: 99.37%

-

Sign

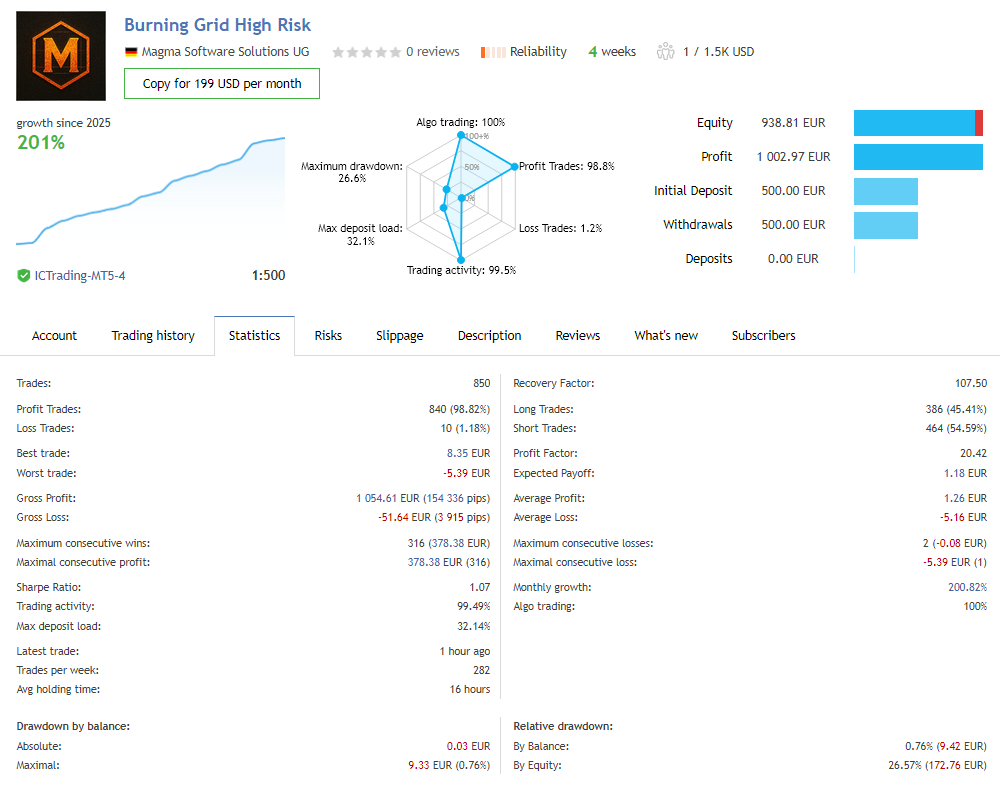

🔹 Excessive Threat

-

Progress: 201%

-

Revenue: €1,054.61

-

Max DD: 26.57%

-

Revenue Issue: 20.42

-

Trades: 840

-

Win Fee: 98.82%

-

Sign

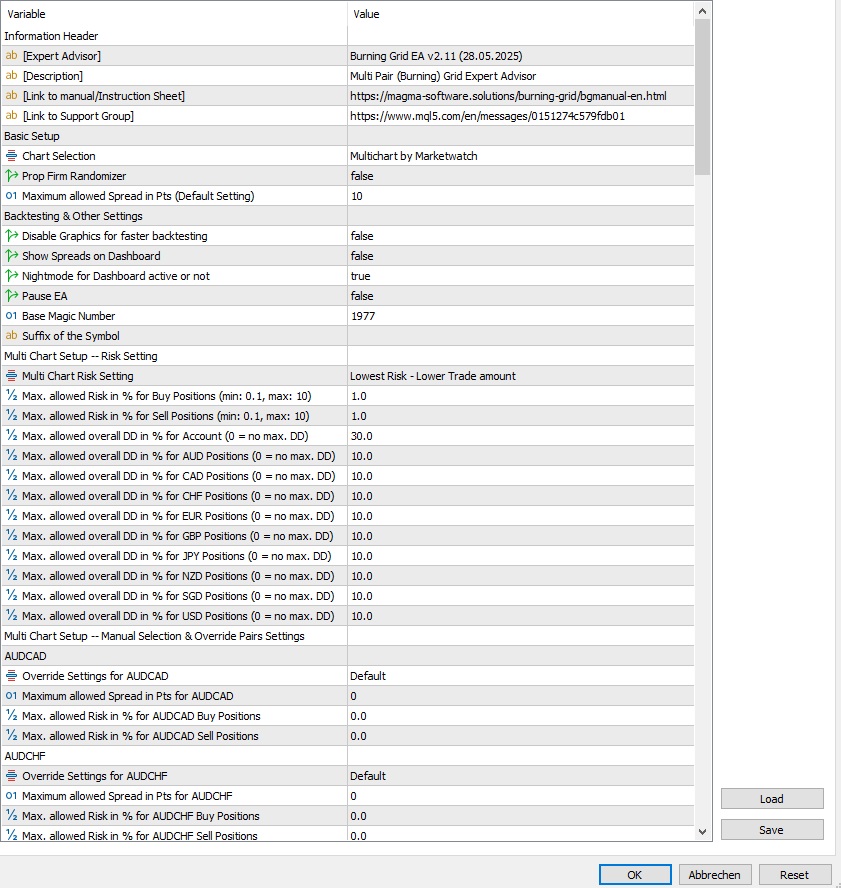

🧩 Chapter 5 – Interface, Setup & Knowledgeable Mode

5.1 EA Interface

Clear logic, shade coding, and presets make configuration simple even for newcomers. Every part may be collapsed or totally expanded for management.

5.2 Prop Agency Prepared

Burning Grid is designed with prop agency necessities in thoughts:

-

Clear threat modeling with out hidden scaling

-

No latency tips or delayed orders

-

Non-obligatory “Prop Agency Randomizer” shifts entry factors barely per technique and pair, stopping sample detection and making certain behavioral uniqueness

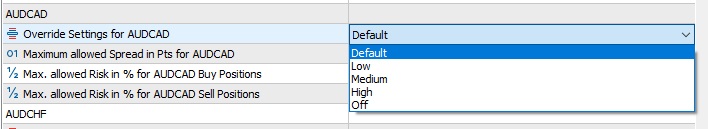

5.3 Presets & Superior Management

Superior customers can override the worldwide EA settings for any particular pair:

-

Drive Low/Medium/Excessive profile for an emblem

-

Customise Unfold or Purchase/Promote Threat %

-

Set to “Off” for full deactivation of the pair

This enables granular pair-level management for fine-tuning.

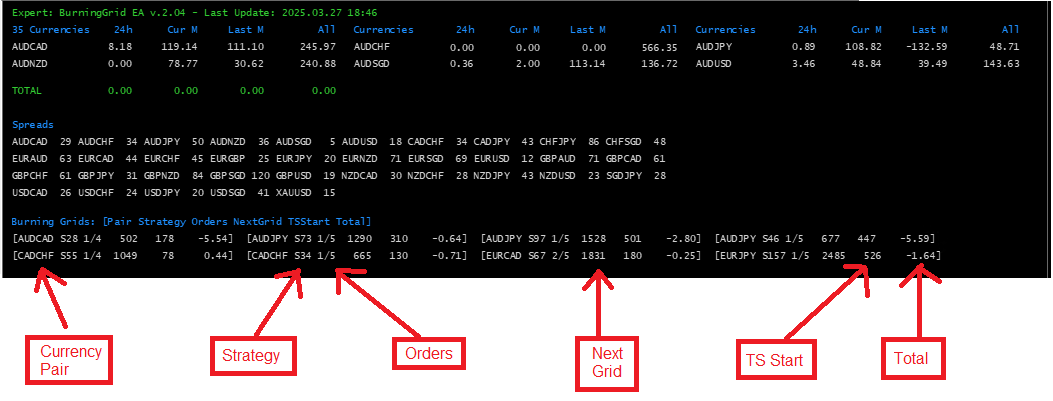

5.4 Visible Dashboard – Actual-Time Threat Monitoring

Burning Grid’s dashboard visualizes stay buying and selling situations:

-

Energetic methods per image

-

Present publicity and drawdowns

-

Capital utilization and fairness standing

-

Account- and currency-level cease loss zones

Shade alerts and structured structure permit on the spot overview and quick decision-making.

✅ Chapter 6 – Last Ideas & Name to Motion

Burning Grid EA gives a brand new option to commerce grids:

-

Structured, risk-limited methods

-

No Martingale, no limitless publicity

-

Backed by verified stay efficiency

-

Full compatibility with prop agency challenges

🟢 Whether or not you are a non-public dealer or making ready for a agency analysis—Burning Grid supplies a strategic edge with out compromise.

🔗 Study extra, check it in demo, or comply with the verified MQL5 alerts linked above.