Crypto analyst Dealer Mayne is cautioning that Bitcoin could also be establishing for a sharper drawdown earlier than resuming its broader uptrend into year-end, arguing {that a} “$98,000 weekly liquidity degree” sits uncollected under value and might be focused early in October.

Two Value Situations For Bitcoin

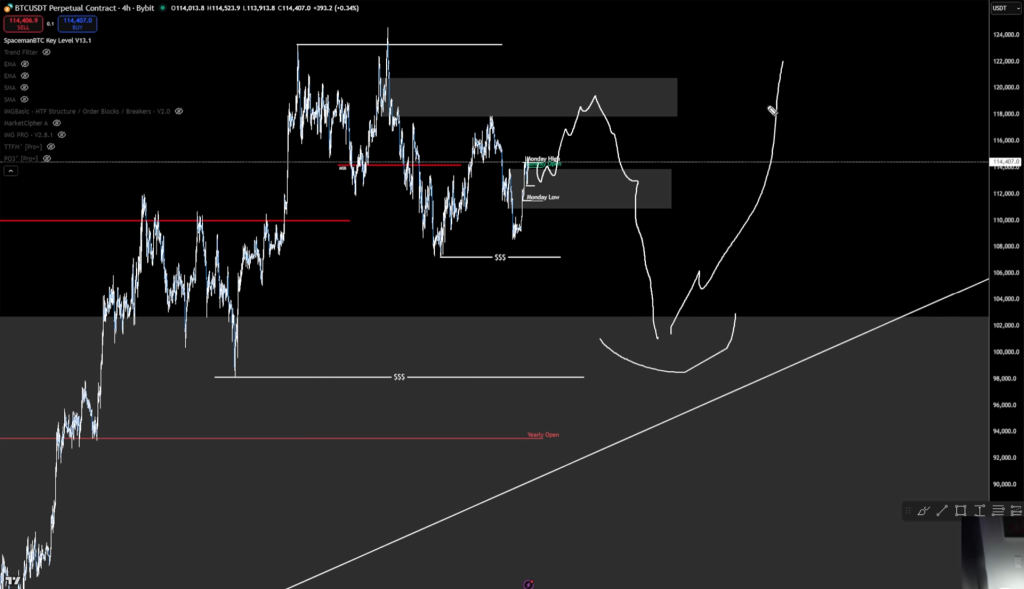

In a video evaluation posted on September 30 titled “Did Bitcoin Simply Prime? The Sign Everybody’s Ignoring…,”Mayne outlined a two-track playbook: a tactical lengthy on a lower-timeframe liquidity sweep that would precede a deeper correction, and, if that setup fails, a decisive flush that takes out $98,000 earlier than a fourth-quarter continuation larger.

Associated Studying

“TLDR — I believe we’re due for a bigger correction quickly, to take out the $98k weekly liquidity degree,” Mayne wrote in his teaser by way of X, including that “there could also be a brief time period lengthy arrange that precedes that correction” and that he nonetheless expects larger costs in This fall, making “an early dump…a shopping for opp.”

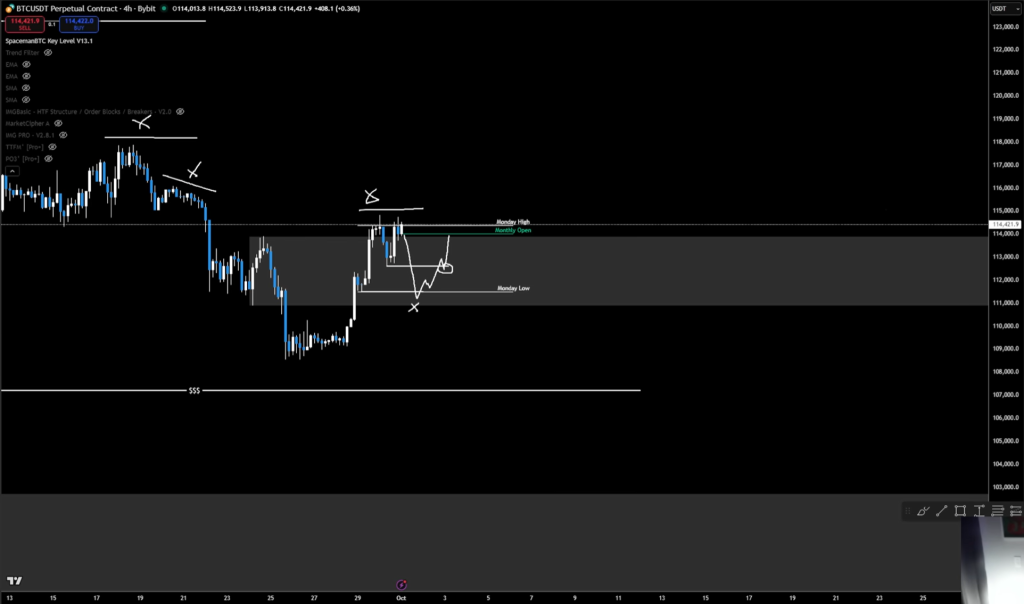

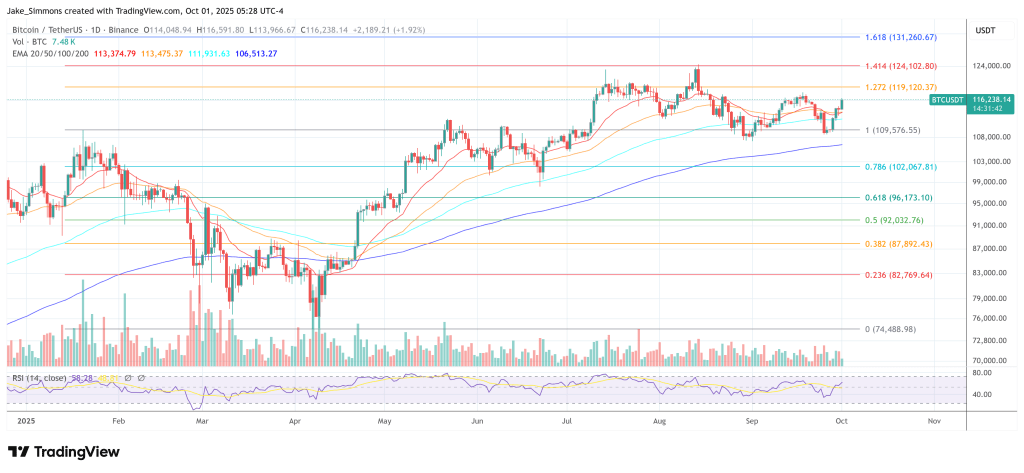

On Bitcoin’s construction, Mayne stated the market has revered his current roadmap: a push up, a retest, and now a choice level outlined by higher-timeframe “breaker” ranges and intraweek lows. “We had the every day flip bullish on Bitcoin, proper? We closed above the breaker,” he stated, noting that whereas the month-to-month chart can also be constructive, “the weekly chart is technically bearish.”

With two larger timeframes leaning bullish in opposition to a smooth weekly, he’s seeking to the four-hour chart to synchronize the following commerce. “If the H4 is bullish, which it’s, if I take a setup on some type of liquidity run on the H4, that’s going to sync me again up with the every day a minimum of.”

Associated Studying

The fast set off, in his view, is a sweep of native lows to tighten danger relatively than “aping” right into a broad retest with a large invalidation. “I wish to see one in all these H4 little liquidity swimming pools right here get run after which…that turns into my setup and my cease is tight. I’ve clear targets over right here,” he defined.

He highlighted “Monday’s low” as a related pivot that, if taken, may produce a mean-reversion lengthy into a close-by every day bearish breaker and prior highs. “Possibly we even run this primary, proper? After which get the pullback. However both method, that’s what I’m in search of on Bitcoin right here.”

Mayne underscored that invalidation is non-negotiable. If value loses the intraweek baseline on a closing foundation, he abandons longs and prepares for a bigger washout. “If Bitcoin will get an H4 shut under right here…we’ll in all probability nuke to $98,000,” he stated, tying the set off to a failure again under Monday’s low and the vary flooring. In different phrases, the identical liquidity dynamics he seeks to take advantage of for a tactical bounce may, in the event that they break, speed up the “$98k” clean-out he believes the weekly chart nonetheless “owes.”

One Final Dip Earlier than This fall Fireworks

He mapped the Ethereum construction as analogous, with the every day and 12-hour tendencies flipping constructive right into a weekly order block, however with the identical want for a exact entry by way of a low-timeframe liquidity seize. “ETH very comparable, proper? We had the every day flip bullish…we’ve bought the breaker. It’s retesting this order block right here,” he stated. He described an H12/weekly mixture the place a “weekly SFP” and “construction break” are in movement, however burdened placement of the cease stays “tough” except a Monday-low sweep affords a cleaner set off. “To me, ETH seems to be good right here to fill in a few of this…assuming we are able to get that setup,” he added.

The conditional nature of the plan is central. Mayne is prepared to aim continuation longs into close by resistance if and provided that the market prints the sweep that tightens his invalidation. Failing that, he expects draw back first. “If we don’t get this little setup to right here, I believe there’s a really sturdy likelihood that we’re going to, you already know, a minimum of do one in all these, proper? and nuke this liquidity right here after which get the true transfer up,” he stated. He reiterated the timeframe verify: “If we get an H4 shut under Monday’s low [near $111,000]…all bets are off and we’d really begin the month of October down.”

Regardless of the warning, the macro-tactical stance stays buy-the-dip for This fall. Mayne repeatedly framed any early-October weak spot as a possibility relatively than the beginning of a cyclical high. “Finally, I’m of the mindset that…this dip that will come, whether or not it’s from proper right here or after a push larger…is a dip we wish to purchase ’trigger we’re within the endgame right here,” he stated. “It’s October, November, December. We’re in This fall… I consider we commerce larger in This fall.”

At press time, BTC traded at $116,238.

Featured picture created with DALL.E, chart from TradingView.com