What to Know:

- Arthur Hayes predicts Bitcoin’s conventional four-year cycle is formally over

- Fed fee cuts and international liquidity growth create unprecedented bullish circumstances

- Bitcoin Hyper presale surges previous $22.9M as buyers place for brand new market paradigm

Arthur Hayes, the crypto billionaire who was pardoned by President Trump and by some means at all times manages to be each controversial and proper, simply dropped a manifesto declaring Bitcoin’s sacred four-year cycle formally deceased.

RIP to probably the most dependable sample in crypto, apparently.

In his newest Substack publish, dramatically titled Lengthy Dwell the King, the previous BitMEX boss argues that all the things we thought we knew about Bitcoin’s cyclical habits is about to be thrown out the window. The macroeconomic tea he’s spilling truly is sensible this time.

When the Fed prints cash prefer it’s going out of fashion and China joins the worldwide liquidity get together, Bitcoin thrives.

With Trump actually screaming at Jerome Powell to slash rates of interest quicker, which he truly did in September 2025, and China deciding to cease being the enjoyable police on financial growth, we’re getting into what Hayes calls an period the place ‘cash shall be cheaper and extra plentiful.’

Conventional cycle watchers predict Bitcoin to hit its peak quickly after which nosedive 70% to 80%, prefer it’s completed for the previous decade.

However the institutional cash that doesn’t panic promote throughout dips (as a result of, properly, establishments have precise risk-management methods) can actually change this non secular yearly ritual, simply as Hayes says.

Suppose Hayes is true. His observe document, regardless of his self-deprecating humor about his predictions being fairly unhealthy, is definitely fairly stable. In that case, we’re a structural shift in how Bitcoin behaves in response to financial coverage.

Having lately hit $22.9M, $HYPER is positioning itself to trip the $BTC wave with a utility-first method – a Bitcoin Layer-2 – that really is sensible on this new liquidity-driven atmosphere.

Bitcoin Hyper’s presale is actually providing a reduced entry level into this macro thesis earlier than the mainstream catches on.

Bitcoin Hyper: The place Solana Pace Meets $BTC Safety

When Hayes talks about Bitcoin benefiting from elevated liquidity, he’s speaking about infrastructure that may truly deal with that liquidity with out charges going parabolic or transactions taking 45 minutes.

Bitcoin Hyper ($HYPER) is constructing precisely that infrastructure.

So, what’s Bitcoin Hyper, and what separates it from the on line casino of shitcoins flooding your X feed?

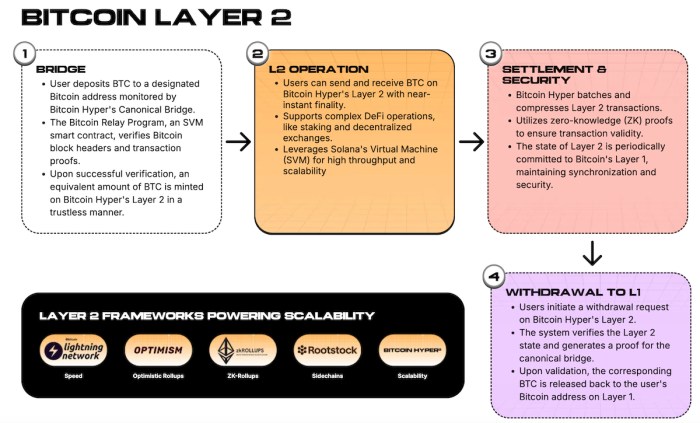

It is a crypto mission constructing an precise Layer-2 (L2) answer that can carry Solana’s legendary velocity to Bitcoin’s unmatched safety.

Bitcoin Hyper will combine the Solana Digital Machine as a Layer-2 on Bitcoin, related through a Canonical Bridge. Principally, it’s taking Bitcoin’s Fort Knox-level safety and giving it a Ferrari engine.

The Canonical Bridge will allow asset transfers between Bitcoin’s major chain and Bitcoin Hyper’s L2, which means you get to maintain Bitcoin’s battle-tested decentralization whereas executing transactions at Solana-level speeds.

No extra selecting between safety and scalability, as a result of Bitcoin Hyper gives you each. That is exactly what institutional cash wants because it floods into crypto. So Hayes’ thesis is coming full circle.

Builders will be capable of deploy Solana-style dApps on Bitcoin’s ecosystem, tapping into Bitcoin’s liquidity whereas sustaining the transaction throughput that really makes DeFi usable.

The tokenomics are designed for sustainability; not a fast rug pull. The workforce has allotted vital parts to staking rewards and ecosystem growth, which suggests they’re enjoying the lengthy sport, exactly the sport you need to play if Hayes’ post-cycle thesis is right.

Arthur Hayes is just not an infallible crypto oracle; the person himself admits his predictions have been hit and miss.

Arthur Hayes is just not an infallible crypto oracle; the person himself admits his predictions have been hit and miss.

However when a billionaire who’s been in Bitcoin since earlier than it was cool begins speaking about structural market adjustments backed by precise Fed coverage and international liquidity information, possibly it’s value paying consideration.

And when a presale like Bitcoin Hyper positions itself particularly to capitalize on this precise macro atmosphere, with precise utility and bonafide staking yields, that’s strategic positioning.

Proper now you should buy $HYPER for simply $0.013095 per token, and stake it for 51% APY. $HYPER value predictions, by the way in which, forecast a possible $0.253 by the tip of 2030.

Be part of the Bitcoin Hyper presale now.

Authored by Elena Bistreanu, NewsBTC –