exchange-traded funds (ETFs) recorded $667.4 million in web inflows on Could 19, the biggest single-day complete since Could 2, signaling renewed institutional curiosity.

Practically half of those inflows, $306 million, went into iShares Bitcoin Belief (IBIT), now at $45.9 billion in web inflows, in response to information supply Farside Traders.

The renewed demand follows bitcoin’s sturdy value efficiency, having traded above $100,000 for 11 consecutive days, which has helped restore market confidence.

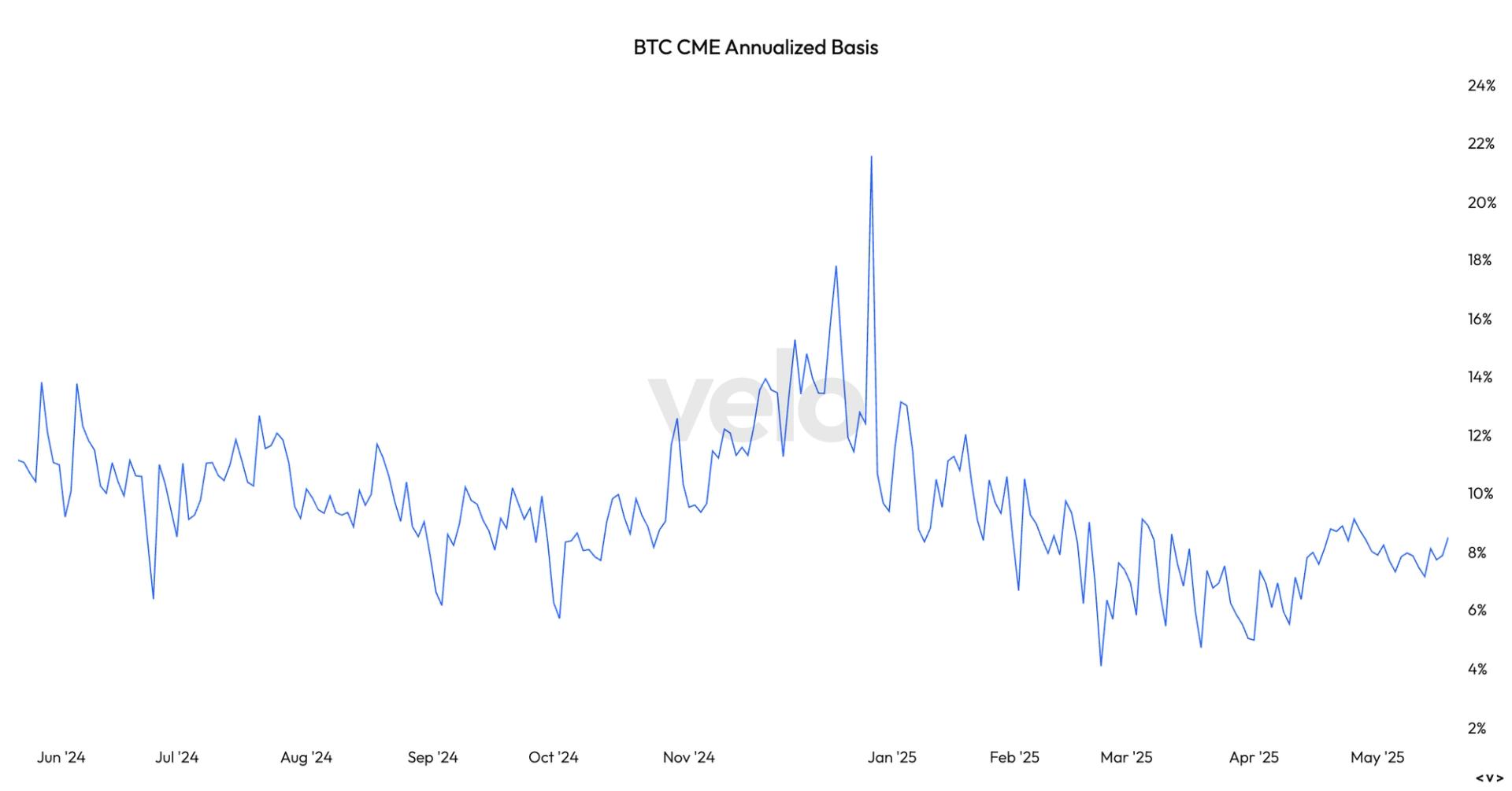

Moreover, the annualized foundation commerce, a technique the place traders go lengthy on the spot ETF and concurrently quick bitcoin futures contracts on the CME, has grow to be more and more enticing, with yields approaching 9% virtually double what was seen in April.

In keeping with Velo information, this has sparked a modest uptick in foundation commerce exercise as evidenced by a rise in buying and selling exercise within the CME futures.

On Monday, CME futures volumes hit $8.4 billion (roughly 80,000 BTC), the very best since April 23. In the meantime, open curiosity stood at 158,000 BTC, up over 30,000 BTC contracts from April’s lows, additional underscoring the rising urge for food for leveraged and arbitrage methods.

That mentioned, each each futures quantity and open curiosity stay nicely under the degrees seen throughout bitcoin’s all-time excessive of $109,000 in January, indicating there’s nonetheless vital headroom for additional development.

The upswing within the foundation suggests the expansion could also be already occurring, bringing again gamers that left the market early this yr when the premise dropped to below 5%.

Current 13F filings revealed that the Wisconsin State Pension Board exited its ETF place in Q1, seemingly in response to a then-less favorable foundation commerce atmosphere. Nonetheless, provided that 13F information lags by 1 / 4 and the premise unfold has since widened from 5% to almost 10%, it’s believable that they’ve re-entered the market in Q2 to capitalize on the improved arbitrage alternative.