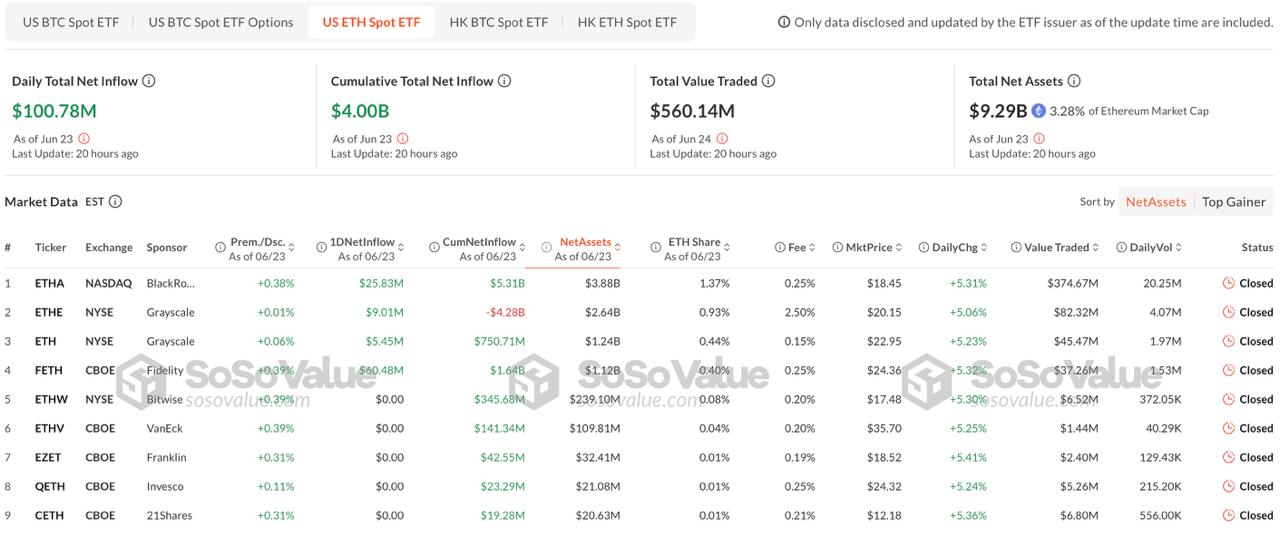

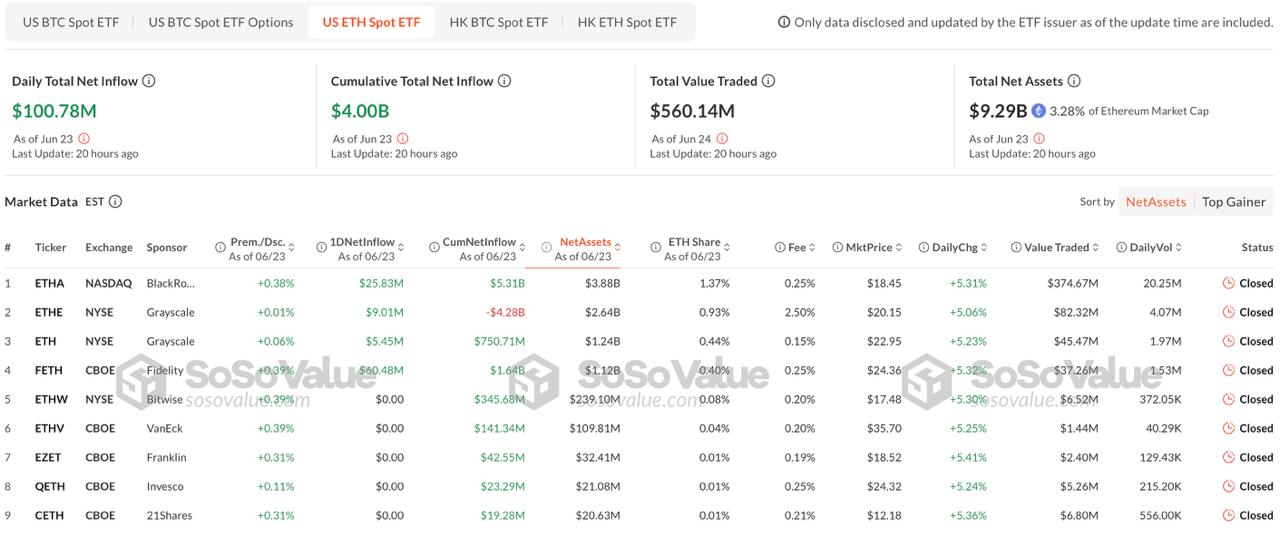

Spot Ethereum ETFs within the U.S. have formally crossed the $4 billion mark in web inflows, and what’s shocking is how rapidly that final billion arrived. After taking 216 buying and selling days to succeed in $3 billion, it took simply 15 extra periods so as to add the following billion. That sudden acceleration indicators one thing has modified in how traders are approaching Ethereum. With Ethereum ETF inflows gaining pace, asset managers are beginning to take discover.

The funds launched in July 2024, in order that they’ve been dwell for just below a yr. Till not too long ago, inflows had been regular however modest. Then, someday in late Could, capital began coming in quicker. The latest surge accounted for a full quarter of all web inflows, packed into only a small slice of the whole buying and selling days.

Who’s Pulling within the Money

BlackRock remains to be main the cost. Its iShares Ethereum Belief has pulled in over $5.3 billion in gross phrases. Constancy’s fund has accomplished properly too, attracting round $1.6 billion. In the meantime, Grayscale’s older ETHE belief has seen outflows of greater than $4.2 billion.

Spot Ethereum ETFs within the U.S. have surpassed $4 billion in web inflows simply 11 months after launch, with $1 billion added prior to now 15 buying and selling days alone. BlackRock’s ETHA leads with $5.31 billion in inflows, adopted by Constancy’s FETH and Bitwise’s ETHW. In the meantime,… pic.twitter.com/cE2ib1ylMv

— CoinPhoton (@coinphoton) June 25, 2025

That’s not a coincidence. Grayscale’s product fees a 2.5 p.c price, which is considerably greater than the 0.25 p.c charges charged by each BlackRock and Constancy. With that type of hole, it’s not onerous to see why traders are transferring their cash. Prices matter greater than ever now that Ethereum ETFs have gotten a long-term play slightly than only a wager on worth swings.

DISCOVER: Greatest New Cryptocurrencies to Spend money on 2025

Why the Timing Makes Sense

A part of the latest momentum comes right down to a couple of key developments. Ethereum’s worth has began to recuperate regarding Bitcoin, which tends to attract consideration. Additionally, new IRS steerage helped make clear how staking rewards are handled inside these ETF constructions. That eliminated plenty of uncertainty that had been preserving wealth managers on the sidelines.

24h7d30d1yAll time

One other piece of the puzzle is that asset managers are rebalancing portfolios. That sounds technical, but it surely typically means massive establishments are adjusting their publicity and taking crypto extra significantly as a slice of broader funding methods. As a substitute of ready to see what occurs, some are beginning to deal with Ethereum as an actual asset class price together with.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Retail Is Main for Now

A lot of the flows to date seem like coming from retail traders and smaller wealth advisory companies. As of March 31, institutional holdings made up lower than one third of the whole ETF balances. That leaves room for far more development, particularly as soon as the following batch of quarterly disclosures comes out in mid-July. If we begin to see extra giant companies coming into the image, the tempo of inflows may shift once more.

Greater Image Is Taking Form

Ethereum ETFs should not the one ones seeing motion. Spot Bitcoin ETFs additionally posted robust inflows across the similar time, suggesting that investor curiosity in digital property is broadening. And now that each asset courses can be found in regulated, low-fee codecs, some traders could also be comfy going past Bitcoin and constructing out extra diversified crypto publicity.

The query now’s whether or not this curiosity in Ethereum can hold constructing. With charges dropping, steerage clearing up, and efficiency bouncing again, the items are falling into place. If bigger establishments observe retail into these ETFs, $4 billion may not be the ceiling for lengthy.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

Ethereum ETFs within the U.S. crossed $4 billion in web inflows, with the ultimate billion added in simply 15 buying and selling days, exhibiting a pointy uptick in investor demand.

BlackRock and Constancy are main the pack with decrease charges, whereas Grayscale’s ETHE continues to see main outflows on account of greater prices.

New IRS steerage on staking rewards and a recovering Ethereum worth are serving to drive recent inflows, notably from wealth managers.

Retail traders are nonetheless dominating flows, however there’s rising potential for institutional adoption within the coming quarters.

With each Ethereum and Bitcoin ETFs gaining traction, crypto is changing into an even bigger a part of diversified funding portfolios.

Why you may belief 99Bitcoins

Established in 2013, 99Bitcoin’s workforce members have been crypto specialists since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Initiatives Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the most recent updates, traits, and insights delivered straight to your fingertips. Subscribe now!