October 10 was no odd day in crypto. Sure, Donald Trump “retaliated” after China introduced new plans curbing uncommon earth metallic exports. Reality Social, X, that’s traditional Trump. The president gained’t hesitate to indicate how mighty the US is.

The reality of the matter is: Information of recent tariffs on China was not anticipated to drive a mega drawdown on that skinny Friday night. A -10% drop in Bitcoin could be excessive. Nonetheless, issues rapidly went south on that October 10, and after what may very well be a relatively “small” set off, the world’s most dear coin crashed from over $120,000 to beneath $105,000 in 15 quick minutes.

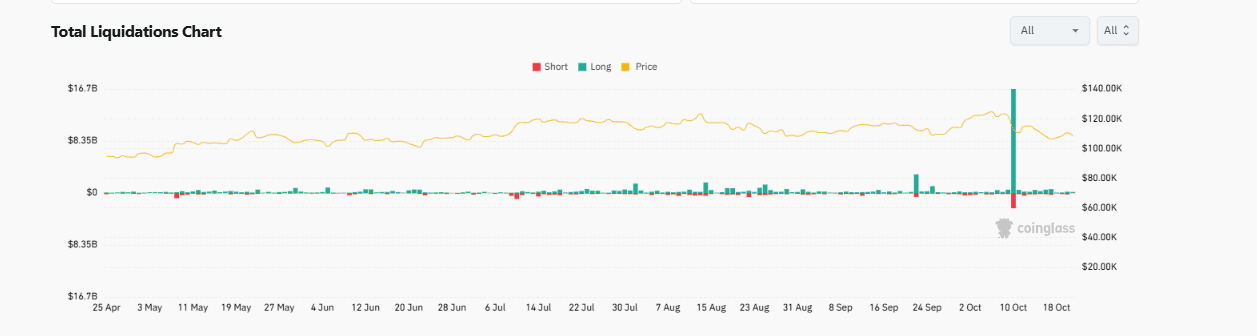

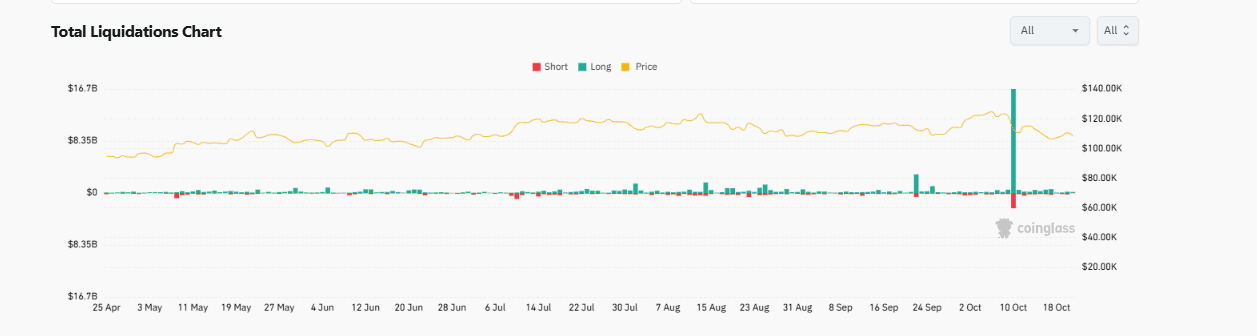

In accordance with Coinglass, over $16Bn of leveraged positions, lengthy and quick, have been liquidated on October 10. The sheer measurement of this liquidation makes October 10 the most important single-day liquidation occasion in historical past; a real crypto black swan occasion.

(Supply: Coinglass)

DISCOVER: 10+ Subsequent Crypto to 100X In 2025

What Occurred? Why Did Crypto Fail? Manipulation or System Failure?

On the floor, it’s straightforward accountable Trump.

Nonetheless, digging deeper, Trump had nothing to do with the “different” stoop outdoors of a gentle correction that will ordinarily see BTC USD and a number of the greatest cryptos to purchase drop -10% max.

There have been theories. Some blame Binance, the world’s largest crypto trade, and others assume this was nothing greater than insider buying and selling.

For individuals who consider the sell-off was as a consequence of insider exercise, they cite the large shorts on Bitcoin and Ethereum positioned lower than an hour on Hyperliquid earlier than the drop.

As 99Bitcoins reported, the dealer, allegedly linked to the Trump household, denied all associations and mentioned funds belong to purchasers.

Others, nonetheless, squarely blame Binance. Of their view, the trade exacerbated the drop by reportedly withdrawing liquidity and (un)deliberately amplifying volatility on what’s often a skinny Friday night when merchants are making ready for the weekend.

Whether or not it was a systemic failure or not, merchants and market makers, together with Wintermute, have been wrecked.

> Binance inner oracles trigger $400B in liquidations in flash crash

> Binance gives $40M in “restoration airdrop”> Founders declare Binance expenses $5M+ in predatory token itemizing charges

> Binance threatens authorized motionAre we noticing a sample right here?

Get your funds off Binance.— curb.sol (@CryptoCurb) October 14, 2025

An nameless whale on Binance misplaced over $450M when his BTC USDT lengthy place was closed. Wintermute misplaced over $300M. One other hedge fund from China misplaced over $180M. The listing goes on and on.

A Market‑Maker Buddy Speaks Out: What Precisely Occurred on the Night time of 10/11 at Binance | Let Information and Details Communicate

I used to do spot–futures arbitrage, I’ve fairly just a few market‑maker mates. Lots of them knew, instantly or not directly, that I suffered heavy losses. Mockingly,… pic.twitter.com/gUbH4LFaO9— 812.eth👁 (@GammaPure) October 20, 2025

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Lawsuits Are Coming: Wintermute CEO

To settle down merchants and hedge funds, Binance dished out goodies, airdropping BNB to meme coin merchants on the Binance Sensible Chain.

Nonetheless, this isn’t sufficient. Consultants are actually anticipating a brand new wave of sophistication motion fits that will goal market manipulators, exchanges, and even liquidity suppliers.

On X, Arthur Cheong, the CIO of DeFiance Capital, is already asking victims to message him ought to they need to sue any CEX they really feel ought to have completed one thing to cap losses.

PSA to my mates:

Should you suffered materials losses on CEX in the course of the flash crash of tenth October and want to get recommendation on pursuing this additional, be at liberty to dm me.

Have constructed up vital high-stakes industrial litigation expertise so may give an knowledgeable view on it.

— Arthur (@Arthur_0x) October 19, 2025

Binance would possible change into the goal of potential litigation.

In a latest podcast, Evgeny Gaevoy, the CEO of Wintermute, mentioned they’re already evaluating their authorized choices and would sue Binance as a result of malfunction of their auto-deleveraging (ADL) programs. Gaevoy mentioned their ADLs have been executed at utterly ridiculous costs.

Wintermute CEO @EvgenyGaevoy on how they acquired ADL’d on Binance and predicts lawsuits and challenges from buying and selling companies. pic.twitter.com/d2hGXoOOHc

— cryptotesters (@cryptotesters) October 20, 2025

Usually, centralized exchanges would ADL positions during times of maximum volatility to handle dangers. Whereas it’s the “final resort,” Gaevoy mentioned Wintermute needed to take in positions at ridiculous and unreasonable costs that didn’t replicate market actuality.

He notes a notification the place a brief place was closed at 5X the precise market worth, resulting in what he mentioned was an on the spot and unhedgeable loss.

DISCOVER: 9+ Finest Excessive-Threat, Excessive-Reward Crypto to Purchase in 2025

Wintermute CEO: Wave of Lawsuits After October 10 Crypto Flash Crash

-

Crypto crashed on October 10, wiping over $16Bn of leveraged positions -

Donald Trump triggered the sell-off -

Massive whales misplaced a whole bunch of hundreds of thousands -

Wintermute CEO now says exchanges ought to count on a wave of lawsuits

Why you’ll be able to belief 99Bitcoins

Established in 2013, 99Bitcoin’s staff members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Tasks Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the newest updates, developments, and insights delivered straight to your fingertips. Subscribe now!