DeFi is a well-known phrase within the crypto house; it refers to Decentralized Finance. Cryptocurrencies rely closely on know-how and computational energy. The Bitcoin community’s annual power consumption has been in comparison with total international locations just like the Netherlands and Argentina. That is as a result of digital mining course of utilizing Proof-of-Work (PoW) consensus mechanisms, and it leaves behind enormous carbon footprints. ReFi or Regenerative Finance is right here to reverse the adverse impact crypto has on the surroundings.

Even earlier than crypto, the world was dealing with environmental points like local weather change, air pollution, and deforestation. Conventional finance was under no circumstances serving to carry any adjustments, however ReFi may have a larger influence on the planet. It’s a motion to make our environment greener and more healthy for us and the longer term generations to return.

What’s ReFi?

ReFi or Regenerative Finance makes use of the know-how and options of blockchain networks to advertise sustainability and regeneration. In comparison with conventional finance, which relies on extracting worth, ReFi goals at regeneration. As an alternative of chopping down a tree for value-generation, a tree is tokenized and added to the blockchain as an environmental asset to generate worth. It will promote sustainability, cash that may make an environmental distinction with every transaction.

ReFi goals at bringing carbon credit into the blockchain, permitting people and companies to offset emissions by means of Decentralized Autonomous Organizations (DAOs). The safe and clear blockchain community will help ReFi in monitoring the impact it has on the surroundings and in making certain the funds are used as promised.

Main ReFi Tasks

ReFi isn’t just in principle; it’s already in existence and actively making a optimistic impact on the planet. Listed here are a few of these initiatives:

1. Toucan Protocol

Bridges carbon credit to the blockchain by turning them into Carbon reference tokens (TCO2). This undertaking goals to make a carbon credit market, the place it’s tokenized and traded in transparency. They created BCT (Base Carbon Tonne), a standardized liquid pool for carbon tokens.

2. KlimaDAO

KlimaDAO is a decentralized autonomous group (DAO) that’s designed to drive carbon credit score token costs up. It acts like a decentralized carbon reserve foreign money. The thought is to make air pollution costly and carbon credit worthwhile.

3. Celo

Celo is a carbon-neutral, proof-of-stake blockchain that’s accessible on cell, aimed toward making DeFi instruments accessible for everybody. This community makes use of very minimal computational energy and power, and nonetheless, the small carbon footprint is offset by means of a partnership with Local weather Collective.

4. Regen Community

This community creates a market for tokens which might be verified ecological impacts or enhancements. Scientists and ecologists create protocols that can be utilized by farmers and landowners for regenerative agriculture, reforestation, or another ecologically useful observe, like no-till farming, enhancing soil well being, and many others. That is verified utilizing means like satellite tv for pc imagery, on-ground sensors, and such to be supplied as verifiable tokens. People, buyers, and firms can fund these for optimistic outcomes.

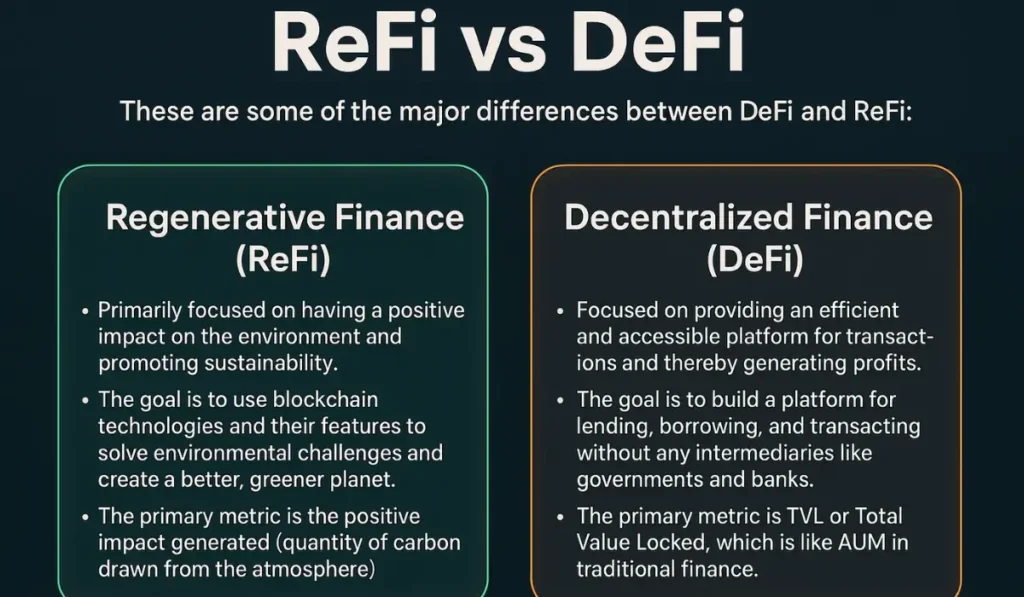

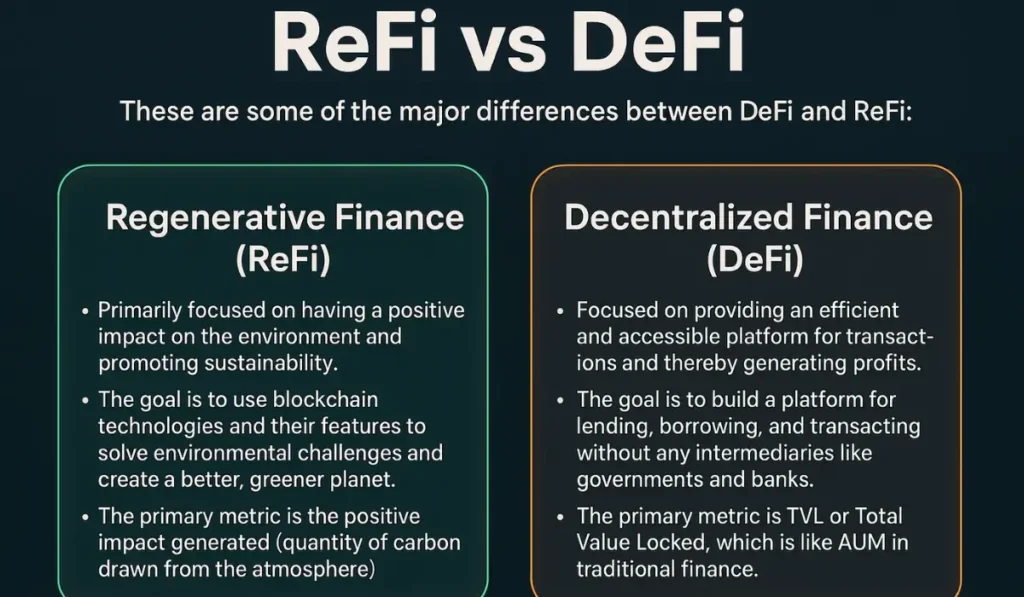

ReFi vs DeFi

These are a few of the main variations between DeFi and ReFi:

| Regenerative Finance (ReFi) | Decentralized Finance (DeFi) |

|---|---|

| Primarily targeted on having a optimistic influence on the surroundings and selling sustainability. | Centered on offering an environment friendly and accessible platform for transactions and thereby producing income. |

| The objective is to make use of blockchain applied sciences and their options to resolve environmental challenges and create a greater, greener planet. | The objective is to construct a platform for lending, borrowing, and transacting with none intermediaries like governments and banks. |

| The first metric is the optimistic influence generated ( amount of carbon drawn from the ambiance) | The first metric is TVL or Complete Worth Locked, which is like AUM in conventional finance. |

How ReFi Works

When giant factories or corporations mass-produce, they go away behind enormous carbon footprints. It’s legally required to restrict these footprints, and one of many methods corporations achieve this is by shopping for carbon credit. A carbon credit score is the same as one metric ton of carbon dioxide equal, which will be purchased, offered, or retired. So if an organization emits extra carbon than the authorized restrict, they will purchase carbon credit to offset the impact. This carbon credit score is introduced into the blockchain community by means of ReFi.

- A technique for measuring, reporting, and verifying a optimistic influence on the surroundings is created by ecologists or scientists. Guidelines for issuing carbon credit may even be supplied together with these.

- A undertaking developer will implement the methodology and acquire knowledge for reporting and verifying, as said.

- The collected knowledge is then verified in opposition to the methodology by means of the decentralized community, identical to how transactions are verified within the Bitcoin community. After verification, the optimistic influence is measured and tokenized.

- These tokens are then listed on markets, which creates liquidity, permitting them to be purchased, offered, or retired.

Why ReFi Issues

When DeFi got here, it modified how folks conceived cash. Cryptocurrency is digital cash that’s not managed by governments or banks. ReFi or Regenerative finance goals on the regeneration of the surroundings reasonably than extraction like different currencies. As an alternative of competitors when it comes to worth, this promotes collaboration, and reasonably than short-term acquire, it goals at long-term influence. ReFi empowers native communities by incentivising sustainability and promotes a greener planet.

Last Ideas – ReFi

Local weather change is actual, and one of many major causes for that’s carbon emissions. With an rising inhabitants and their calls for resulting in deforestation, air pollution, and international warming, it’s excessive time folks begin giving consideration to sustainability. Cash has all the time been extractive in nature until ReFi got here round. As an alternative of chopping down bushes for revenue or worth technology, this crypto idea tokenizes these ecological belongings and builds worth for them.

Cryptocurrency disrupted the worldwide monetary markets, altering all the pieces about how folks seen cash. ReFi has the potential to carry extra to the desk than only a decentralized foreign money; it’s aimed toward making the world greener by making the method extra rewarding and inclusive to folks from all walks of life. Regenerative Finance globalizes sustainability, breaking borders and norms, serving to people and organisations in constructing a greater surroundings in a verified, scalable, and clear mannequin. Perhaps at some point, ReFi would assist see bushes and forests as extra priceless than timber and produce down carbon emissions for a greener and more healthy planet.