Washington’s newest retirement push may ship contemporary 401(ok) cash towards Bitcoin earlier than anticipated.

Home Republicans on Tuesday launched the Retirement Funding Alternative Act, a invoice that will flip President Donald Trump’s August govt order into legislation.

The proposal formally opens the door for retirement plans to incorporate “various belongings,” comparable to funds investing in digital currencies.

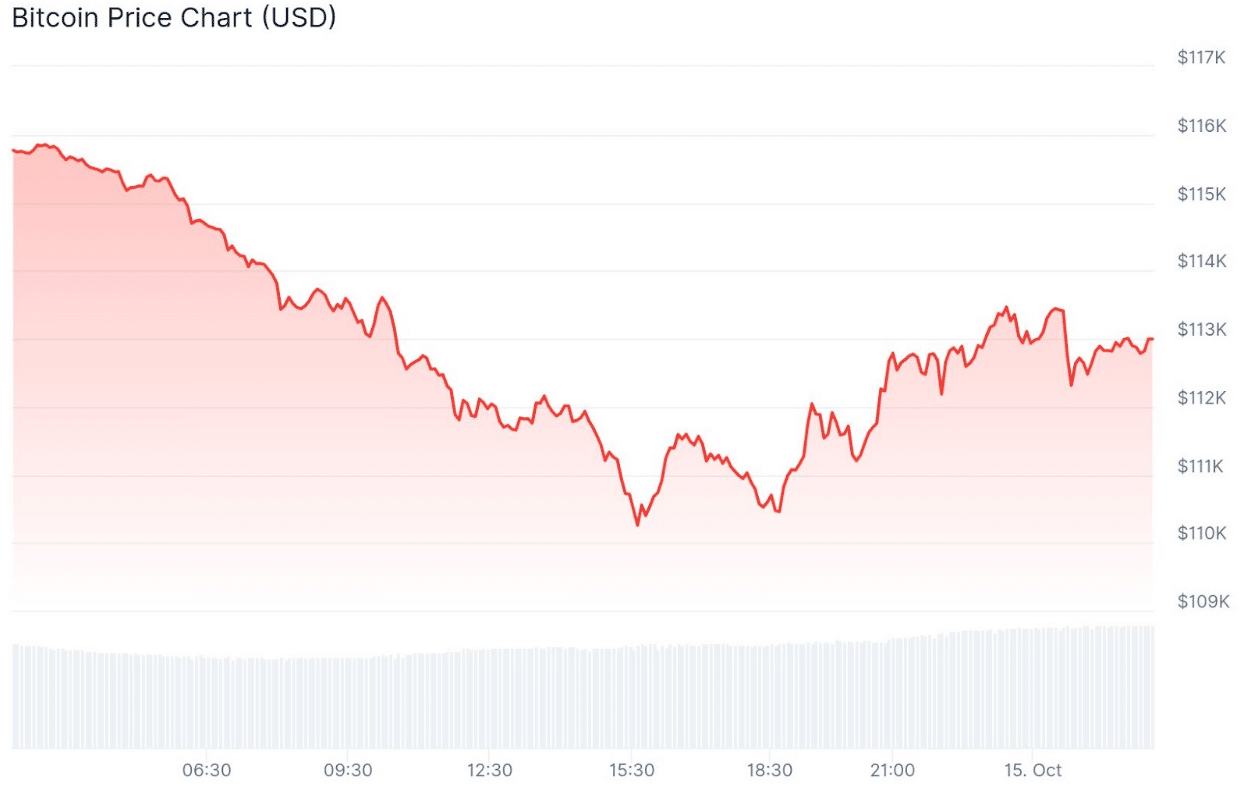

The transfer comes as regulators advance steerage on the difficulty, with Bitcoin buying and selling close to $113,000 in a risky market.

If handed, the laws would give Government Order 14330 the total drive of legislation. It directs the Labor Division and Securities and Trade Fee to make room for a wider vary of funding decisions in defined-contribution plans like 401(ok)s.

How Will the 180-Day Deadline Have an effect on Employer Retirement Plans?

Whereas the order doesn’t require plans to supply crypto, it particularly mentions “actively managed funding automobiles that spend money on digital belongings.”

It additionally units a 180-day deadline for the Labor Secretary to make clear fiduciary duties, doubtlessly together with safe-harbor protections for employers who select to supply such choices.

In Might, the Labor Division rescinded its 2022 steerage that had urged plan sponsors to train “excessive care” with crypto-related merchandise.

The rollback marked a shift to a impartial stance, neither endorsing nor discouraging digital asset publicity in retirement portfolios.

In September, the Labor Division stated it plans to suggest new guidelines clarifying when asset-allocation funds that embrace alternate options may be provided. The company additionally hinted at potential protected harbors for fiduciaries dealing with such merchandise.

“This Advisory Opinion gives much-needed readability and certainty because the division works towards issuing proposed rules,” Deputy Secretary Keith Sonderling stated on the time.

Bitcoin is buying and selling round $112,985, with intraday strikes between roughly $110,099 and $115,916.

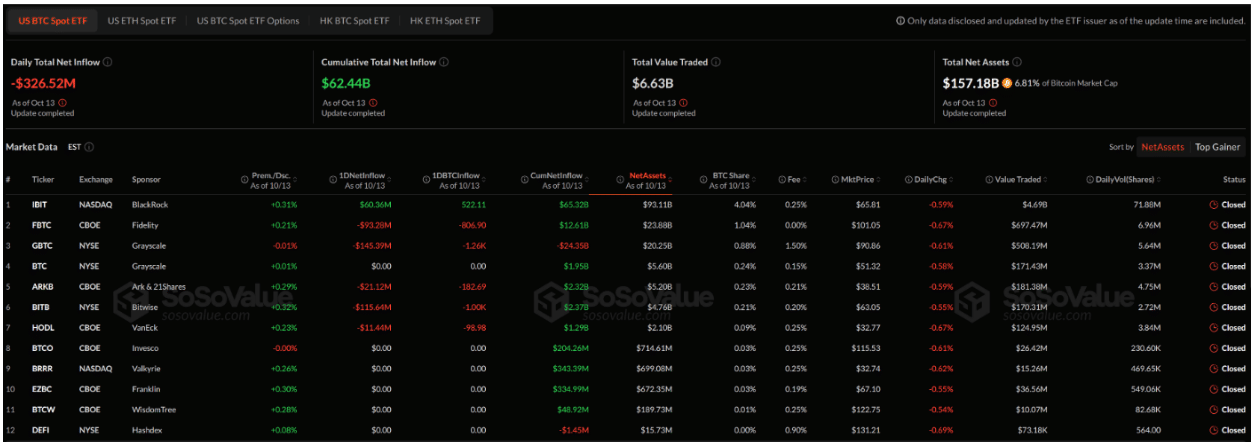

In line with SoSoValue information, US spot Bitcoin ETFs noticed about $326.5 million in internet outflows on Tuesday, as world markets weakened amid renewed US-China commerce tensions.

The brand new govt order directs regulators to coordinate on how various belongings can match into default choices and managed retirement portfolios.

This issues as a result of most savers depend on target-date or professionally managed funds.

DISCOVER: 9+ Greatest Excessive-Threat, Excessive-Reward Crypto to Purchase in October2025

Why Are BlackRock and KKR Creating Retirement-Prepared Funding Merchandise?

Business momentum is rising quick. Empower backed the order in August, saying they plan to increase entry to personal investments and cryptocurrency alongside lifetime-income choices.

Main asset managers, together with BlackRock and KKR, at the moment are growing retirement-friendly merchandise.

Non-public-market corporations are taking a look at how you can make their choices match the daily-priced construction of defined-contribution plans.

Supporters in Congress say this flexibility may assist diversify portfolios with out weakening ERISA protections. A Home Monetary Providers Committee letter final month praised the order and urged the Labor Division to create a proper “protected harbor” by way of rulemaking.

Not everybody agrees. Critics warn that including alternate options, particularly crypto, may elevate charges, restrict liquidity, and produce extra volatility to 401(ok) plans.

In the meantime, veteran dealer Peter Brandt has shared how he’s positioning himself for retirement.

In a current submit on X, he stated he plans to maintain 5% of his Bitcoin holdings in his retirement portfolio.

I consider my greatest wager is to:

1. Convert my very own buying and selling from every day charts to weekly charts for so long as I can achieve this

2. High quality dividend shares

3. Rising mkts

4. Gold and Silver

5. 5% BTC— Peter Brandt (@PeterLBrandt) October 13, 2025

The remark got here as a follow-up to a query he’d earlier posed to his followers about funding methods later in life.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Brandt’s method goes past Bitcoin. He’s specializing in regular earnings and decrease threat. Brandt can also be selecting dividend-paying shares for regular earnings. He’s additionally including emerging-market publicity for progress and investing in treasured metals like gold and silver as a hedge towards inflation.

He additionally stated he’s slicing again his buying and selling exercise. He’s shifting from every day to weekly trades to sluggish his tempo as he nears retirement.

This technique marks a transfer towards stability and dependable returns.

But, conserving 5% of his portfolio in Bitcoin, he reveals he nonetheless believes within the asset’s long-term energy. That is true even after the market’s current hunch.

To Brandt, Bitcoin stays a hedge towards inflation, his model of digital gold.

His method displays a easy message: as retirement nears, steadiness and regular earnings matter greater than hype.

Brandt additionally defined why actual property didn’t lower, saying property costs are inflated and will see a serious correction quickly.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s crew members have been crypto specialists since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Tasks Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the newest updates, developments, and insights delivered straight to your fingertips. Subscribe now!