With President Donald Trump transferring forward with sweeping tariffs, and the European Union saying it stands able to impose “agency counter-measures,” customers are anxious, markets are in tumult, and companies are on edge.

“Tariffs are taxes that will likely be paid by the individuals. Tariffs are taxes for the Individuals on their groceries and their medicine. Tariffs will simply gas inflation, precisely the other of what we wished to attain,” EU President Ursula von der Leyen warned the European Parliament.

Small companies have specific purpose to be involved, particularly if a commerce warfare breaks out and results in a world recession, as some economists concern.

This text appears particularly at small companies, the menace tariffs might pose to them and what small companies can do to assist climate tariffs and a recession:

- Small companies make use of the most important share of personal employees.

- Tariffs will adversely have an effect on the sustainability of small companies in each home and worldwide markets.

- A commerce warfare might result in a recession, and small companies are inclined to collapse throughout financial contractions.

- Value administration and advertising and marketing are crucial to the survival of small companies throughout recessions.

- Maximizing the worth of your property, time, and expertise is the most effective method.

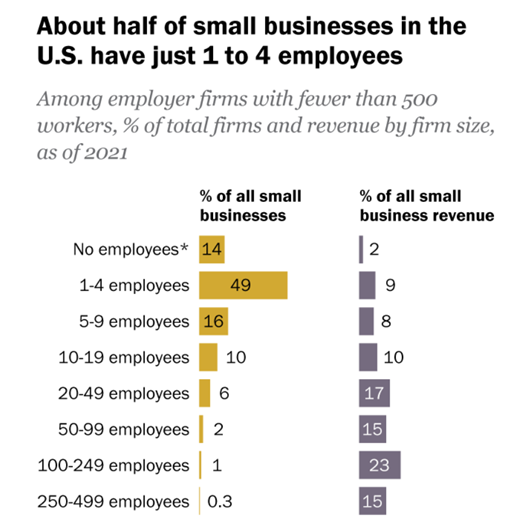

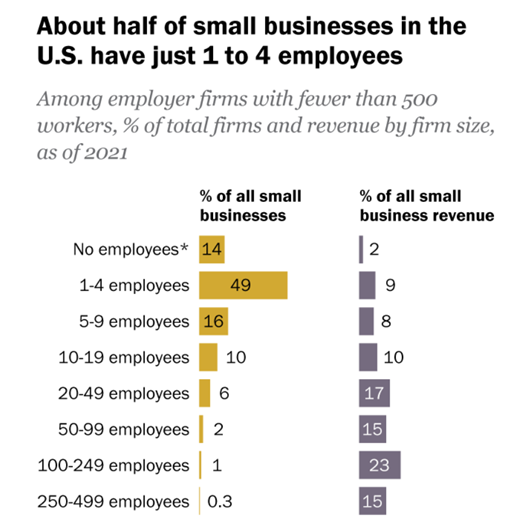

Small companies are the most important group of employers within the U.S. Although outlined as any enterprise with underneath 500 employees, small companies usually have far fewer workers: The bulk have not more than 20.

Regardless of all this, small companies as a gaggle make use of some 61.7 million people. That’s nearly half (46.4%) of all non-public employees (U.S. Small Enterprise Administration Workplace of Advocacy). This makes small enterprises a mammoth contributor to the U.S. financial system.

The Affect of Tariffs and Commerce Wars on Small Companies

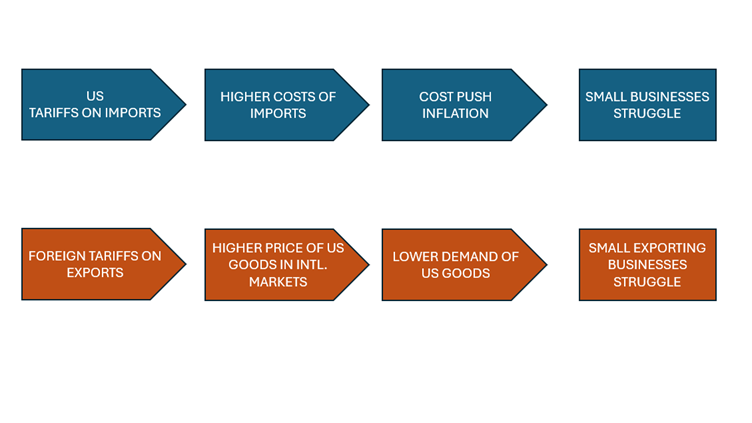

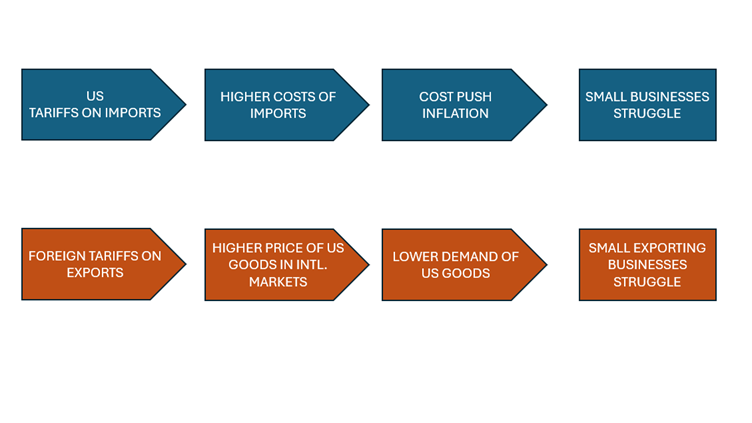

Tariffs are taxes imposed on imported items offered inside america. If the U.S. authorities imposes a tariff on sure items, these tariffs will not be paid by governments or companies exporting to the U.S. As an alternative, many of those taxes ultimately are paid by American customers.

The rise within the worth of imported items has a profound influence within the U.S. home market. Over two thirds of small to medium native companies depend on imports for both manufacturing or as merchandise for distribution. When dealing with tariffs on important imports, companies are pressured to move the tax onto their customers.

Whereas bigger firms are in a greater place to soak up some lack of enterprise as a result of worth hikes, smaller companies face an existential menace as their smaller buyer base dwindles. To not point out, this creates price push inflation as costs are inclined to rise all through the financial system.

The influence shouldn’t be restricted to companies counting on imports and working within the home market. A commerce warfare arises amid an financial dispute between two or extra nations. Within the case of tariffs, any nation focused by the U.S. might reply by imposing tariffs on U.S. items exported to their shores. Whereas the residents of that nation are those that pay the tariffs, U.S. producers are nonetheless harm. The upper price of U.S. items and providers overseas will end in decrease demand in worldwide markets. Native companies basically will lose no less than a few of their worldwide clients.

A shocking variety of small companies produce domestically and depend on exports of their items. Small companies make up 97% of companies that export their items, though they comprise solely 35% of complete exports by worth (Workplace of Advocacy). Which means quite a few small companies are inclined to depend on smaller however far more frequent transactions with nations like Canada, Mexico, and China, our largest small enterprise buying and selling companions. These three nations stick out as they’ve lately been topic to tariffs from the present administration and introduced retaliatory tariffs of their very own. Unsurprisingly, small companies are anticipated to battle and even shut down as a result of political turbulence within the financial system.

Assessing the 7 Greatest Nations for Doing Enterprise

Tariff-Induced Financial Slumps

Recessions are a decline in financial exercise lasting quite a lot of months. They’re typically a results of a mix of things, and it’s unclear if a commerce warfare can result in one. Regardless, the potential of a tariff-induced financial hunch in 2025 is growing (CNBC). Recessions have various levels of severity in response to areas. For instance, southern states like Florida, Georgia, Mississippi, Alabama suffered the best financial losses throughout the Nice Recession of 2008; whereas northeastern states like Vermont, Connecticut, New Hampshire, and Maine had a softer touchdown (Reuters). As with tariffs, small companies are additionally notably susceptible to financial slumps.

There are two main components that account for why small companies face a higher menace throughout a recession. Firstly, small companies are extremely unlikely to have a big market share. That’s, they typically exist in extremely aggressive markets the place the margins for each revenue and error are usually low. In occasions of financial uncertainty and poor gross sales – as a result of recession, inflation, and different components – small companies are extremely prone to failure (NY Fed). Bigger companies will not be resistant to the influence of recessions however typically have extra wiggle room to soak up the influence as a result of a bigger market share and better revenue margins.

The second main issue is the provision of credit score. A drop in client spending coupled, on this case, with inflation and a tax rise (tariffs are taxes) might result in the next demand for credit score as money reserves dwindle whereas companies attempt to keep afloat. A big spike in inflation might also result in the federal reserve growing rates of interest, elevating the price of credit score for companies and customers. Bigger non-public establishments are inclined to face much less issue in buying credit score (and even bailouts, as was the case within the Nice Recession). Smaller companies are inclined to have smaller property and different types of collateral. A tightened entry to credit score and opposed monetary circumstances implies that small companies bear the brunt of financial and job losses, and closures. This sample is obvious in earlier recessions.

Worldwide Capabilities of Shopping for and Promoting Companies

Recessions and Small Enterprise: What the Knowledge Reveals

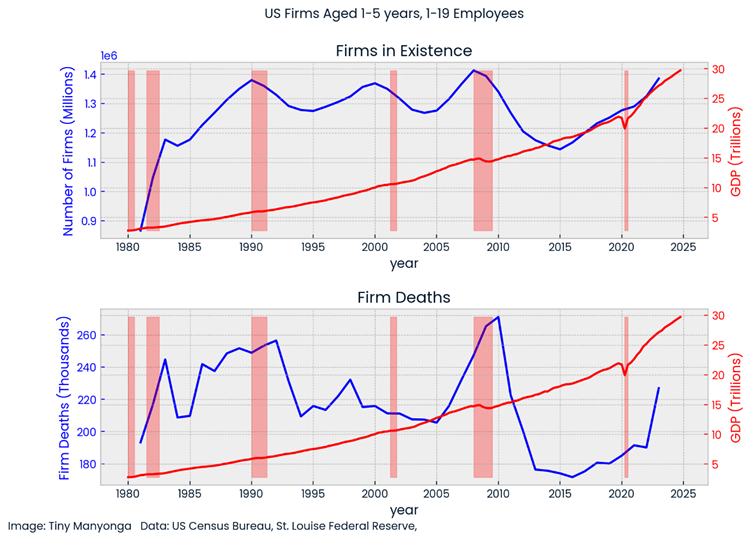

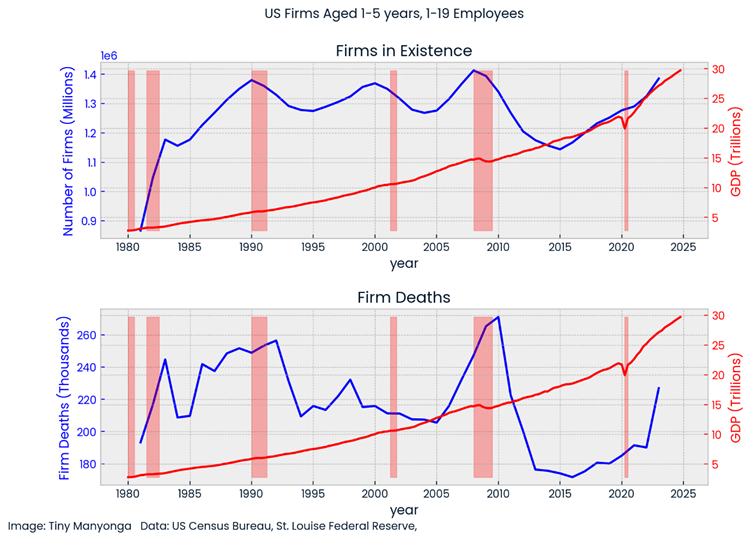

The determine above focuses on small companies within the U.S. (underneath 20 workers) which were in existence for five years or much less as of the 12 months the statistics had been launched. On the left are the variety of corporations in existence (prime) and the variety of corporations that closed (backside). On the precise is the U.S. GDP and the years highlighted in pink are the intervals formally acknowledged as a recession by the federal reserve. A couple of notable traits seem.

- The variety of new small companies fluctuated through the years however is comparatively steady during the last 45 years.

- The most important hunch was within the aftermath of the good recession and that lasted about 5 years.

- Agency closures are inclined to spike when approaching and through recessions; probably the most notable spike being from 2005 to 2010.

- The pandemic had a delayed spike in enterprise closures, almost definitely due to authorities aid funds and the expectation that the pandemic wouldn’t final. After the lifting of lockdowns and the cessation PPP mortgage packages, there was one other spike in enterprise closures.

How one can Rent Worldwide Staff in 5 Steps

Mitigating Threat: How one can Save Your Small Enterprise

Each small enterprise proprietor faces completely different market circumstances and pressures. But, sure themes are frequent to all new enterprise homeowners. In response to Forbes, about 1 in 5 companies fail within the first 12 months and that charge rises to half inside 5 years. That is generally as a result of both an absence of capital or an absence of market. Relying on the severity of a possible recession and the financial circumstances, the failure charge is prone to rise in the midst of this and the next years.

| Years in Enterprise | Enterprise Failure Charge |

| 1 | 20% |

| 2 | 30% |

| 5 | 50% |

Addressing the most typical causes for failure is a balancing act throughout a possible financial hunch. Elevating capital in a high-interest surroundings when monetary establishments are tightening credit score generally is a herculean process. It’s paramount to rigorously handle out there money reserves. However, making a market typically means spending cash on advertising and marketing campaigns and creating demand to your items or providers. A mix of options to think about embrace lowering the price of important enterprise bills which are needlessly excessive whereas using efficient advertising and marketing methods at a sustainable funds. Beneath are a few strategies to handle the 2 commonest causes of enterprise failure.

1. Hiring Philosophy

Unsurprisingly, labor is probably the most vital price for small companies, adopted by stock. In response to Forbes, labor prices could make up 70% of a enterprise’s spending. One optimistic end result within the enterprise world that resulted from the pandemic is the development of distant work expertise. In a recession, there are job losses and a rise in unemployment. Naturally it’s anticipated that the unemployment charge will go up and wage calls for will go down. Nevertheless, this refers to actual wages, that’s the worth of wages within the face of the present price of residing. In an inflationary surroundings coupled with financial uncertainty and the fixed menace of tariffs, the precise greenback quantity of wages within the U.S. is prone to rise.

Nevertheless, because it stands, it is a regional financial phenomenon. Larger tariffs and the resultant price inflation are (no less than for now) restricted to the U.S. and its main buying and selling companions. As an alternative of absorbing nominal wage hikes and consuming into money reserves, it might be extra prudent to think about offshore hiring for remote-capable roles in what you are promoting. Extremely certified professionals are sometimes out there at a fraction of U.S. prices.

2. Do Not Neglect Advertising

All enterprise homeowners know that they ignore advertising and marketing vulnerable to their very own peril. Among the many most important phases of a small enterprise is the leap from being a sole proprietor in a localized market and attempting to make the leap to being a state-wide and even nation-wide model. Social media has been instrumental in propelling many small companies from being a one-man band to a bigger entity. Nevertheless, it is a leap that can not be taken alone and discovering the precise individuals to help with this leap generally is a life-or-death determination for the enterprise.

In response to Forbes, 1 in 3 small companies don’t have an internet site, spend about 9% of their income on advertising and marketing, and but, the dearth of market want is the second commonest purpose small companies fail. A full-time advertising and marketing skilled could also be too expensive for a small enterprise, however there are seasoned advertising and marketing professionals internationally able to elevating your model with out committing your money reserves throughout opposed monetary environments.

5 Instruments and Suggestions for Entrepreneurs Touring Internationally

3. Underutilized Useful resource Administration

Among the many most vital points mentioned are the unavailability of credit score in financial slumps. Whereas some companies are inclined to furlough or lay-off workers to avoid wasting money, that is typically not an choice for many small companies. Over 60% of small companies have lower than 5 workers, and every worker is usually crucial to the operation or survival of the enterprise. In circumstances the place releasing workers shouldn’t be a chance, enterprise homeowners should think about different methods to avoid wasting money.

Contemplate any assets which are underutilized within the enterprise. The obvious locations to start out are the enterprise’ property, together with autos, buildings, cupboard space, or equipment. Any property that can be utilized to generate another income supply have to be thought of. One may collaborate with different small companies to offer transportation providers with an underused truck or lease out extra cupboard space, for instance. Nevertheless, one asset typically neglected is the enterprise proprietor themselves.

4. Time and Expertise Administration

House owners typically put on many hats of their enterprise. They’re the CEO that additionally manages operations, maintains the monetary data, is chargeable for enterprise improvement, and carries out HR/payroll features. Arguably, an important position for a enterprise proprietor is to develop the enterprise and determine new alternatives. However as an alternative of engaged on the enterprise, many homeowners discover themselves working within the enterprise. Much less time devoted to increasing the enterprise’ market, revenue streams, or enhancing provider networks implies that what you are promoting is unlikely to outlive financial turbulence.

As a enterprise proprietor, it’s best to try to spend extra time engaged on the enterprise, somewhat than in it or placing out fires.

Repetitive duties, together with responding to clients, accounting and bookkeeping, and different day-to-day actions could be delegated to private assistants or different expert employees. Private assistants, accountants, advertising and marketing, and different specialised workers could be employed on an hourly foundation and most can work remotely.

In case you have a enterprise accomplice or on-site worker, then consider their time use and expertise. An on-site worker might have the talents required to develop the enterprise, create networking alternatives, analysis new markets, or determine enhancements within the provide chain. Nevertheless, if they’re spending their time on menial duties, this could possibly be an instance of the losing of potential or expertise.

Free Expertise Coaching: From Figuring out Costs to Authorities Contracting

Conclusion

The tariff coverage is unsure for the time being. It’s unclear, unlikely for some, if a recession will observe in 2025 or 2026. Regardless, companies fail on a regular basis. Over 230,000 companies failed in simply 2023 alone. A standard method to enterprise doesn’t assure success and in an financial surroundings with restricted entry to credit score, utilizing money, property, and human assets could be the distinction between life or demise for what you are promoting. Spend extra time constructing the enterprise, extract the utmost worth of your property, and use the expertise at your disposal to their fullest potential. For routine remote-capable duties, think about hourly wage offshore workers as there’s a vital labor price differential.

We earn a fee should you make a purchase order, at no extra price to you.