15 Jan What’s Rayls (RLS)?

in Training

Rayls is an institutional-grade blockchain ecosystem designed to bridge conventional finance (TradFi) and decentralised finance (DeFi). Positioned as “the blockchain for banks,” it offers monetary establishments with the infrastructure to function privately, settle securely and entry international liquidity—with out compromising compliance, confidentiality or efficiency.

Its intention is straightforward however far-reaching: to unlock greater than $100 trillion in conventional monetary belongings and produce 6 billion banked customers on-chain by combining institutional safeguards with the openness and interoperability of public blockchains.

Institutional-Grade Infrastructure

Monetary establishments demand privateness, predictable efficiency and regulatory certainty—circumstances public blockchains have been by no means designed for. Rayls addresses this via a unified three-layer structure that separates personal institutional execution from public blockchain liquidity and interoperability. This permits establishments to carry key operations on-chain—from consumer account administration and near-real-time cross-border and FX settlement, to the tokenisation and distribution of real-world belongings (RWAs)—all throughout the identical compliant ecosystem.

At a look, Rayls Privateness Nodes are personal, single-node EVM chains operated individually by every establishment for high-throughput inside workflows and confidential execution, with help for gasless or alternative-fee fashions.

Rayls Personal Networks are permissioned, multi-institution settlement layers that join teams of Privateness Nodes into shared, ruled environments for interbank settlement and regulatory-aligned collaboration. A number of Personal Networks can exist, every serving particular jurisdictions, asset courses or consortium teams.

Above these sits the Rayls Public Chain, an EVM Layer-1 providing predictable USD-pegged fuel charges payable utilizing stablecoins together with USDt, quick and deterministic finality, dangerous MEV (Maximal Extraction Worth) safety and compliant entry to international liquidity. The Rayls Public Chain additionally periodically commits state roots to Ethereum, inheriting Ethereum’s safety features, offering censorship-resistance and restoration assurances aligned with the broader Ethereum ecosystem.

All three elements run on a unified execution stack powered by Reth, making certain constant efficiency and seamless interoperability throughout personal and public environments. Each the Rayls Public Chain and Personal Networks presently use an RBFT-based consensus mannequin, with the general public chain scheduled emigrate in 2026 to Rayls Axyl, a next-generation consensus engine engineered for sub-second block instances, deterministic finality and institutional-scale throughput with design targets within the tens of 1000’s of transactions per second.

Rayls additionally incorporates Rayls Enygma, a next-generation cryptographic framework that allows personal transactions and encrypted balances via a mixture of zero-knowledge proofs, encrypted state commitments, and post-quantum safe key alternate. Enygma permits establishments to transact confidentially whereas nonetheless offering regulators with selective visibility, a requirement for CBDCs, tokenised deposits, and interbank settlement. Rayls in the meantime, offers native on-chain identification companies, enabling establishments to confirm counterparties and implement compliance necessities utilizing cryptographic attestations, whereas preserving consumer privateness and EVM compatibility.

Though Rayls is designed primarily for banks, its public chain is absolutely open and, being EVM-compatible, permits builders, dApps and retail customers to construct and transact on the identical infrastructure utilized by such establishments.

Rayls infrastructure is already being utilized by greater than 25 main monetary establishments throughout manufacturing and pilot environments.

The Brazilian Central Financial institution’s Drex CBDC pilot, for instance, is utilizing Rayls to allow personal institutional settlement and encrypted transaction flows for each central and industrial banks. Núclea, the most important monetary market infrastructure supplier within the Southern Hemisphere, is utilizing Rayls to energy tokenisation and receivables platforms at nationwide scale. In the meantime Cielo, Brazil’s largest service provider acquirer, started constructing fee and yield-bearing asset merchandise on Rayls in This fall 2025. The community was additionally ranked No.2 in J.P Morgan’s 2024 EPIC report, recognising it as one of the vital superior institutional blockchain architectures examined in real-world monetary environments.

What Is the RLS Token?

RLS is the Rayls ecosystem’s native utility token, used throughout all three layers of the community for transaction charges, staking, safety and governance. Establishments working Privateness Nodes and collaborating in Personal Networks generate utilization charges denominated in USD however settled in RLS, whereas customers on the general public chain pay predictable USD-priced fuel charges in stablecoins, that are robotically transformed into RLS at settlement. This creates a unified payment market the place all exercise, public or personal, in the end settles in the identical token.

RLS additionally secures the Rayls Public Chain via proof-of-stake. Validators should stake RLS to take part in consensus, course of transactions, and confirm zero-knowledge proofs coming from personal networks. Sincere validators earn RLS rewards funded by community charges, whereas malicious behaviour can result in slashing, offering sturdy financial incentives for proper behaviour.

Past charges and staking, RLS capabilities because the governance token of the Rayls ecosystem. Token holders vote on protocol upgrades, validator necessities, burn parameters, ecosystem grants and different selections that form the evolution of the community as institutional adoption will increase.

Importantly for crypto-native customers, RLS represents a direct financial hyperlink between institutional utilization and token demand. As extra monetary establishments transfer settlement, funds, tokenisation flows and cross-border exercise onto Rayls, their utilization generates charges that should be settled in RLS, making a pure supply of ongoing demand that scales with actual monetary quantity quite than speculative exercise.

Rayls Tokenomics

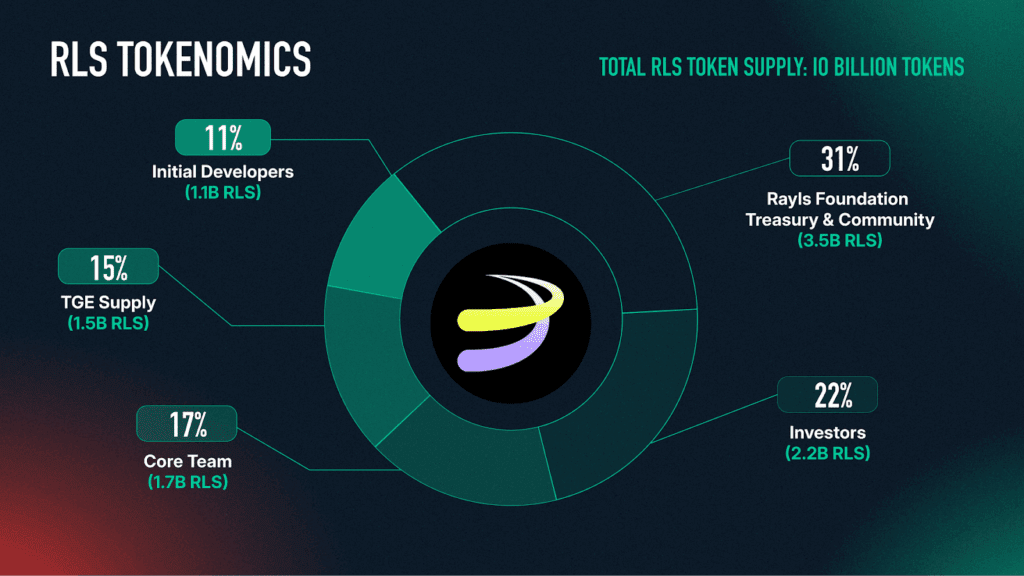

Preliminary Provide and Distribution

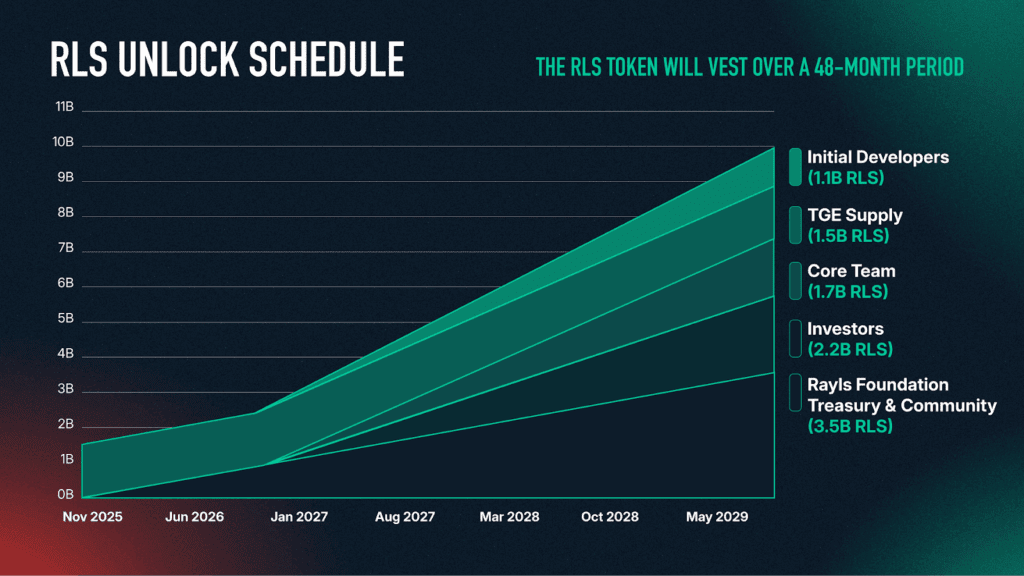

On the Token Technology Occasion (TGE), roughly 1.5 billion RLS (15% of whole provide) entered circulation. The remaining provide is allotted throughout ecosystem growth, contributors, traders and group initiatives, with long-term vesting schedules designed to align incentives with sustainable community progress.

Fastened Provide and Deflationary Design

RLS has a hard and fast whole provide of 10 billion tokens. No extra RLS will be minted. Each transaction throughout Rayls generates RLS charges, that are break up robotically: 50% are burned, completely decreasing circulating provide, and 50% fund the Community Safety Pool, which compensates validators and helps ecosystem growth. As adoption grows, notably throughout institutional workflows, extra RLS is faraway from circulation, creating deflationary stress. As soon as provide falls beneath 70% of the unique quantity, token holders might vote to regulate the burn price.

Rayls may also quickly introduce a Proof of Utilization (PoU) framework, the place anonymised cryptographic proofs of institutional exercise are revealed on-chain, offering clear visibility into community utilization, payment technology and token burns with out revealing delicate transaction or counterparty knowledge.

How you can Purchase RLS on Bitfinex

How you can Purchase RLS with Crypto

1. Log in to your Bitfinex account or enroll to create one.

2. Go to the Deposit web page.

3. Within the Cryptocurrencies part, select the crypto you intend to purchase RLS with and generate a deposit handle on the Change pockets.

4. Ship the crypto to the generated deposit handle.

5. As soon as the funds arrive in your pockets, you may commerce them for RLS. Discover ways to commerce on Bitfinex right here.

How you can Purchase RLS with Fiat

1. Log in to your Bitfinex account or enroll to create one.

2. You might want to get full verification to have the ability to deposit fiat to your Bitfinex account. Find out about completely different verification ranges right here.

3. On the Deposit web page, beneath the Financial institution Wire menu, select the fiat foreign money of your deposit. There’s a minimal quantity for fiat deposits on Bitfinex; be taught extra right here.

4. Examine your Bitfinex registered e mail for the wire particulars.

5. Ship the funds.

6. As soon as the funds arrive in your pockets, you should use them to purchase RLS

Additionally, we have now Bitfinex on cell, so you may simply purchase RLS foreign money whereas on-the-go.

[AppStore] [Google Play]

RLS Group Channels

Web site | X (Twitter) | Discord | Github